During 2022, Inez (a single taxpayer) had the following transactions involving capital assets: How much income tax

Question:

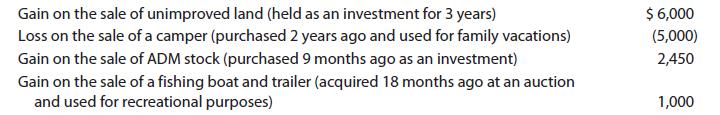

During 2022, Inez (a single taxpayer) had the following transactions involving capital assets:

How much income tax results from these capital asset transactions if:

a. Inez has taxable income of $188,450?

b. Inez has taxable income of $32,250?

Transcribed Image Text:

Gain on the sale of unimproved land (held as an investment for 3 years) Loss on the sale of a camper (purchased 2 years ago and used for family vacations) Gain on the sale of ADM stock (purchased 9 months ago as an investment) Gain on the sale of a fishing boat and trailer (acquired 18 months ago at an auction and used for recreational purposes) $ 6,000 (5,000) 2,450 1,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

a Inez has a net LTCG of 7000 and a net STCG of 2450 Given her taxable income Ine...View the full answer

Answered By

Sarfraz gull

have strong entrepreneurial and analytical skills which ensure quality tutoring and mentoring in your international business and management disciplines. Over last 3 years, I have expertise in the areas of Financial Planning, Business Management, Accounting, Finance, Corporate Finance, International Business, Human Resource Management, Entrepreneurship, Marketing, E-commerce, Social Media Marketing, and Supply Chain Management.

Over the years, I have been working as a business tutor and mentor for more than 3 years. Apart from tutoring online I have rich experience of working in multinational. I have worked on business management to project management.

5.00+

3+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

During 2021, Inez (a single taxpayer) had the following transactions involving capital assets: Gain on the sale of unimproved land (held as an investment for 3 years) $ 6,000 Loss on the sale of a...

-

During 2021, Chester (a married taxpayer filing a joint return) had the following transactions involving capital assets: Gain on the sale of an arrowhead collection (acquired as an investment at...

-

During 2022, Chester (a married taxpayer filing a joint return) had the following transactions involving capital assets: How much income tax results from these capital asset transactions if: a....

-

An opera glass has an objective lens of focal length +3.60 cm and a negative eyepiece of focal length -1.20 cm. How far apart must the two lenses be for the viewer to see a distant object at 25.0 cm...

-

Key figures for the recent two years of Research In Motion and Apple follow. Required 1. Compute the current ratio for both years for both companies. 2. Which company has the better ability to pay...

-

What is the AFN, and how is the percent of sales method used to estimate it? AppendixLO1

-

A 12-sided die, numbered 1 to 12, is rolled. Find the probability that the roll results in an odd number or a number less than

-

Ramakrishnan Inc. reported 2018 net income of $15 million and depreciation of $2,650,000. The top part of Ramakrishnan, Inc.'s 2018 and 2017 balance sheets is listed below (in millions of dollars)....

-

Exercise 2.7: Compass Museum (Statement of financial performance) The following records have been taken from the trial balance of Compass Museum for the year ended 31 December 20X0. C000 C'000...

-

The following balance sheet was prepared for Jared Corporation as of December 31, 2011. The following additional information relates to the December 31, 2011, balance sheet. (a) Cash includes $4,000...

-

Terri, age 16, is a dependent of her parents. During 2022, Terri earned $5,000 in interest income and $3,000 from part-time jobs. a. What is Terris taxable income? b. How much of Terris income is...

-

Nadia died in 2021 and is survived by her husband, Jerold (age 44); her married son, Travis (age 22); and her daughter-in-law, Macy (age 18). Jerold is the executor of his wifes estate. He maintains...

-

The unstretched length of spring AB is δ. If the block is held in the equilibrium position shown, determine the mass of the block at D. Given: δ = 2 m a = 3 m b = 3 m c = 4 m kAB = 30 N/m...

-

Let two planes be given by 2x-y+z = 8 and z = x+y-5 (a) Find the angle between the two planes. Leave your answer in degrees and round to the nearest tenth. (b) Find the vector equation of the line of...

-

9-2. The profile of a gear tooth shown in Fig. P9.2 is approximated by the trigonometric equation y(x) = a. Estimate the area A using eight rectangles of equal width A x = 1/8, b. Calculate the exact...

-

tube is hinged to a rotating base as shown in Fig. 4. At the instant shown, the base rotates about the z axis with a constant angular velocity ! 1 = 2 rad/s. At the same instant, the 2 tube rotates...

-

Find the limit analytically. -7x2+5x-10 lim 0 9x+13x+11 Find the limit analytically. lim +80 4x-13 5x+6x-11

-

Write a recursive function for the running time T(n) of the function given below. Prove using the iterative method that T(n) = (n). function( int n) { if(n=1) return; for(int i = 1; i

-

Conclude with the integrative strategies used in today's global environments to reach targeted markets and maximize marketing dollars spent and consider how you would proceed when marketing a product...

-

In your readings, there were many examples given for nurturing close family relationships in this ever-evolving technological society we live in Based upon your readings and research describe three...

-

Faye, Gary, and Heidi each have a one-third interest in the capital and profits of the FGH Partnership. Each partner had a capital account of $50,000 at the beginning of the tax year. The partnership...

-

Liz and Doug were divorced on December 31 of the current year after 10 years of marriage. Their current year's income received before the divorce was as follows: Doug's salary...

-

Liz and Doug were divorced on December 31 of the current year after 10 years of marriage. Their current year's income received before the divorce was as follows: Doug's salary...

-

Yard Professionals Incorporated experienced the following events in Year 1, its first year of operation: Performed services for $31,000 cash. Purchased $7,800 of supplies on account. A physical count...

-

This question is from case # 24 of book Gapenski's Cases in Healthcare Finance, Sixth Edition Select five financial and five operating Key Performance Indicators (KPIs) to be presented at future...

-

assume that we have only two following risk assets (stock 1&2) in the market. stock 1 - E(r) = 20%, std 20% stock 2- E(r) = 10%, std 20% the correlation coefficient between stock 1 and 2 is 0. and...

Study smarter with the SolutionInn App