During the current year, Diane Stevens made two gifts to her son Greg. The first gift was

Question:

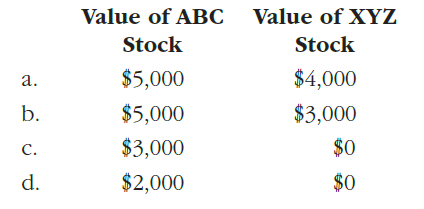

During the current year, Diane Stevens made two gifts to her son Greg. The first gift was ABC stock with a value at the date of the gift of $5,000. Diane?s basis in ABC was $2,000. The second gift, in the same year, was XYZ stock with a value of $3,000 at the date of the gift and a basis to Diane of $4,000. For gift tax purposes, what is the value of the gifts made by Diane to Greg?

Transcribed Image Text:

Value of XYZ Value of ABC Stock Stock $4,000 $5,000 a. $3,000 $5,000 b. $0 $3,000 C. $0 $2,000 d.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 56% (16 reviews)

Value of ABC Sto...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2020 Corporations, Partnerships, Estates And Trusts

ISBN: 9780357109168

43rd Edition

Authors: William A. Raabe, James C. Young, William H. Hoffman, Annette Nellen, David M. Maloney

Question Posted:

Students also viewed these Business questions

-

During the current year, Maine Savings and Loan Association made new loans of $15 million. In addition, the company collected $36 million from borrowers, of which $30 million was interest revenue....

-

Refer to E4-3 and E4-5. E4-3 Diane Company completed its first year of operations on December 31. All of the year's entries have been recorded except for the following: a. At year-end, employees...

-

During the current year, Reddick Corporation incurred the following expenditures which must be recorded either as operating expenses or as intangible assets : a. Expenditures were made for the...

-

The comparative balance sheets for Karidis Ceramics, Inc., for December 31, 209 and 208 are presented on the next page. During 209, the company had net income of $96,000 and building and equipment...

-

What is a prepreg?

-

You\'re working as an HR manager at a tech scale - up with offices in the Netherlands and Belgium. Your current headcount is 5 0 0 employees and your HR department consists of 1 5 employees. Within...

-

Personal probability? When there are few data, we often fall back on personal probability. There had been just 24 space shuttle launches, all successful, before the Challenger disaster in January...

-

Tony Vian owns and manages a computer repair service, which had the following trial balance on December 31, 2013 (the end of its fiscal year). Summarized transactions for January 2014 were as...

-

Fackler Company's quality cost report is to be based on the following data: Quality circles Product recalls Supplies used in testing and inspection Net cost of scrap Liability arising from defective...

-

Your sister has just won $300,000 (taxfree) in the state lottery. Shes decided to quit her job and devote herself to writing novels for the next ten years, using her lottery winnings to support...

-

In May 2019, Dudley and Eva enter into a property settlement preparatory to the dissolution of their marriage. Under the agreement, Dudley is to pay Eva $6 million in full satisfaction of her marital...

-

At the time of his death in 2019, Donald owned a farm (a qualified, closely held business) with a most suitable use value of $5 million and a current use value of $3.5 million. a. If the special-use...

-

The December 31, 2017, balance sheet and the 2018 statement of cash flows for McFarland Corporation follow: Requirement 1. Prepare the December 31, 2018, balance sheet for McFarland. A1 McFarland...

-

Root cause analysis with fish bone diagram and Forecast analysis for the case study "Agarwal Automobiles: Fuel station forecasting and inventory management" with peer reviewed journal references.

-

Suppose that MPI_COMM WORLD consists of the eight processes 0, 1, 2, 3, 4, 5, 6, and 7, and suppose the following code is executed: int sum = my_sum; int iLevel = 0; MPI Status status; for (int...

-

Measuring and monitoring It is the SMT's view that the reduction in accident frequency rate alone clearly indicates that the slips and trips campaign was a success discuss possible limitations of...

-

Identify some of the repercussions of high staff turnover at Eswatini Electricity Company ( EEC ) , especially on critical and skilled employees occupying key positions. Further, differentiate...

-

1. Make sure your report server is setup correctly. 2. Deploy all 10 reports and Shared Data Source. 3. Take a snapshot of each report (Parameters Visible) and paste them in 1 MS Word Document. The...

-

For the following exercises, use the definition of a logarithm to rewrite the equation as an exponential equation. 1 log324 (18) = 2

-

Time Travel Publishing was recently organized. The company issued common stock to an attorney who provided legal services worth $25,000 to help organize the corporation. Time Travel also issued...

-

Barbara owns 40% of the stock of Cassowary Corporation (a C corporation) and 40% of the stock of Emu Corporation (an S corporation). In the current year, each corporation has operating income of...

-

Barbara owns 40% of the stock of Cassowary Corporation (a C corporation) and 40% of the stock of Emu Corporation (an S corporation). In the current year, each corporation has operating income of...

-

Barbara owns 40% of the stock of Cassowary Corporation (a C corporation) and 40% of the stock of Emu Corporation (an S corporation). In the current year, each corporation has operating income of...

-

Break-Even Sales and Sales to Realize Income from Operations For the current year ending October 31, Yentling Company expects fixed costs of $537,600, a unit variable cost of $50, and a unit selling...

-

You buy a stock for $35 per share. One year later you receive a dividend of $3.50 per share and sell the stock for $30 per share. What is your total rate of return on this investment? What is your...

-

Filippucci Company used a budgeted indirect-cost rate for its manufacturing operations, the amount allocated ($200,000) is different from the actual amount incurred ($225,000). Ending balances in the...

Study smarter with the SolutionInn App