Elliott has the following capital gain and loss transactions for 2022. After the capital gain and loss

Question:

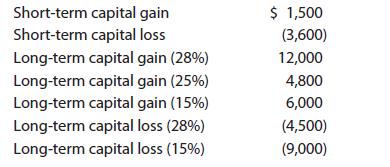

Elliott has the following capital gain and loss transactions for 2022.

After the capital gain and loss netting process, what is the amount and character of Elliott’s gain or loss?

Transcribed Image Text:

Short-term capital gain Short-term capital loss Long-term capital gain (28%) Long-term capital gain (25%) Long-term capital gain (15%) Long-term capital loss (28%) Long-term capital loss (15%) $ 1,500 (3,600) 12,000 4,800 6,000 (4,500) (9,000)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

Elliott first nets the shortterm gains and losses ...View the full answer

Answered By

Susan Juma

I'm available and reachable 24/7. I have high experience in helping students with their assignments, proposals, and dissertations. Most importantly, I'm a professional accountant and I can handle all kinds of accounting and finance problems.

4.40+

15+ Reviews

45+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Elliott has the following capital gain and loss transactions for 2017. After the capital gain and loss netting process, what is the amount and character of Elliotts gain or loss? $ 1,500 Short-term...

-

Elliott has the following capital gain and loss transactions for 2015. Short-term capital gain .......................................... $ 1,500 Short-term capital loss...

-

Elliott has the following capital gain and loss transactions for 2016. Short-term capital gain .................................. $ 1,500 Short-term capital loss ......................................

-

Evaluate and simplify the following derivatives. d dw -(e-w In w)

-

List the components of a DBMS and describe the function of each.

-

Savory Enterprises reported the following information regarding the companys fixed assets in the footnotes to the companys 1996 financial statements. Office furniture $500,000 Less: Accumulated...

-

Web-based exercise. You can find a (very) skeptical look at health claims not backed by proper clinical trials at the Quackwatch site, www .quackwatch.org. Visit the site and prepare a one-paragraph...

-

A firm is concerned about the condition of some of its plant machinery. Bill James, a newly hired engineer, was assigned the task of reviewing the situation and determining what alternatives are...

-

Interest capitalized for 2022 was: On January 1, 2021, Kendall Inc. began construction of an automated cattle feeder system. The system was finished and ready for use on September 30, 2022....

-

GLMH Shipping is a start-up company that plans to offer same-day shipping services between 20 major cities in the U.S. In order to provide this service, GLMH needs to build hubs at airports in...

-

Shen purchased corporate stock for $20,000 on April 10, 2020. On July 14, 2022, when the stock was worth $12,000, Shen died and his son, Mijo, inherited the stock. Mijo sold the stock for $14,200 on...

-

George is the owner of numerous classic automobiles. His intention is to hold the automobiles until they increase in value and then sell them. He rents the automobiles for use in various events...

-

The following list of balance sheet items are in random order for Alexander Farms, Inc., at September 30, 2015: Instructions a. Prepare a balance sheet by using these items and computing the amount...

-

Write out the form of the partial fraction decomposition of the function (see example). Do not determine the numerical values of the coefficients. x3 (a) x + 7x+6 9x+1 (b) (x + 1)3(x + 2) Submit...

-

You desire to make an 80% by weight vinyl acetate to 20% by weight styrene copolymer via free radical, emulsion polymerization. The r 1 and r 2 values for these monomers are 0.01 and 55,...

-

Q1)In a wheel and axle machine the diameters of the wheel and the axle are 450mm and 60mm respectively.The efficiency is 97%(0.97 per unit).When a body having a mass of 40kg is being lifted.Determine...

-

Smith & Chief Ltd. of Sydney, Australia, is a merchandising firm that is the sole distributor of a product that is increasing in popularity among Australian consumers. The company's income statements...

-

C. In lab, you measure the x & y components of a possible incompressible flow field as u = 2cxy; and where cand a are constants. v = c(a + x - y) 5. (04 pts) Short answer, what is necessary for the...

-

The records of Alyssa Company show the following amounts in its December 31 financial statements: Alyssa Company made the following errors in determining its ending inventory : 1. The ending...

-

What are the before image (BFIM) and after image (AFIM) of a data item? What is the difference between in-place updating and shadowing, with respect to their handling of BFIM and AFIM?

-

Compute the undervaluation penalty for each of the following independent cases involving the value of a closely held business in the decedent's gross estate. In each case, assume a marginal estate...

-

Compute the undervaluation penalty for each of the following independent cases involving the value of a closely held business in the decedent's gross estate. In each case, assume a marginal estate...

-

Singh, a qualified appraiser of fine art and other collectibles, was advising Colleen when she was determining the amount of the charitable contribution deduction for a gift of sculpture to a museum....

-

Imagine you are an Investor in the Stock Market. Identify three companies in the Korean Stock Market (KOSPI) where you would like to invest. Explain your answer

-

Domino is 4 0 years old and is married out of community of property with the exclusion of the accrual system to Dolly ( 3 5 ) . They have one child, Domonique, who is 1 1 years old. Domino resigned...

-

YOU ARE CREATING AN INVESTMENT POLICY STATEMENT FOR JANE DOE General: 60 years old, 3 grown children that are living on their own and supporting themselves. She is in a very low tax rate so we don't...

Study smarter with the SolutionInn App