For 2022, Essence Company, a calendar year taxpayer, will change from the cash method for tax purposes

Question:

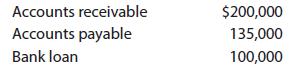

For 2022, Essence Company, a calendar year taxpayer, will change from the cash method for tax purposes to the accrual method. At the end of 2021, Essence showed the following items.

What is the § 481(a) adjustment for this change in accounting method? Be sure to state whether it is positive or negative.

Transcribed Image Text:

Accounts receivable Accounts payable Bank loan $200,000 135,000 100,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

When Essence changes its method of accounting it will compute a 481a a...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

For 2021, Essence Company, a calendar year taxpayer, will change from the cash method for tax purposes to the accrual method. At the end of 2020, Essence showed the following items. Accounts...

-

For 2016, Essence Company, a calendar year taxpayer, will change from using the cash method for tax purposes to the accrual method. At the end of 2015, Essence had the following items: Accounts...

-

For 2019, Essence Company, a calendar year taxpayer, will change from using the cash method for tax purposes to the accrual method. At the end of 2018, Essence showed the following items. Accounts...

-

i. Find a. b. ii. Use the trapezium rule with 2 intervals to estimate the value of giving your answer correct to 2 decimal places. +6 e2x + 6 e2 dx,

-

1. Is this dialog a logical or a physical model? Could it be a phone registration system? Could a clerk at a desk handle the dialog manually? Discuss. 2. Discuss how well this dialog follows the...

-

How much raw material will I need? How much will it cost?

-

Prepare an Income Statement for ABC Hotel in accordance with USHA, based on the following ledger balances for the year ended 30th April, 2005. Also prepare a Balance Sheet as on that date. Accounts...

-

1. Identify the different power issues going on in the case. What types of power do the different parties have? Explain. 2. How are individuals reacting to their power or lack thereof? 3. What types...

-

James' Jeans was established in 2014 by James, a fashion designer who decided to form the business after receiving multiple requests for jeans he had designed and tailored himself. After a few...

-

Perry Co. predicts it will use 25,000 units of material during the year. The expected daily usage is 200 units, and there is an expected lead time of five days and a desired safety stock of 500...

-

In 2022, Chaya Corporation, an accrual basis, calendar year taxpayer, provided services to clients and earned $25,000. The clients signed notes receivable to Chaya that have a fair market value of...

-

In 2022, Aurora received a $25,000 bonus computed as a percentage of profits. In 2023, Auroras employer determined that the 2022 profits had been incorrectly computed, and Aurora had to refund the...

-

For a binary acid, HY, which factors affect the relative ease with which the acid ionizes?

-

Consider the situation you addressed in Problem and Exercise 3. Create numeric cost estimates for each of the costs you listed. Calculate the net present value and return on investment. Include a...

-

The output power \(\dot{W}\) of a spinning shaft is a function of torque \(T\) and angular velocity \(\omega\). Use dimensional analysis to express the relationship between \(\dot{W}, T\), and...

-

In groups of three, pick a local healthcare organization with which you are familiar. Conduct a SWOT analysis on the organization. After completing the SWOT analysis, use the template in exhibit 8.12...

-

The Dean Door Corporation (DDC) manufactures steel and aluminum exterior doors for commercial and residential applications. DDC landed a major contract as a supplier to Walker Homes, a builder of...

-

In Exercises 47 and 48, write a two-column proof. GIVENmWYZ = m/TWZ = 45 PROVE SWZ = ZXYW SW X Y N T

-

Explain the difference between the percentage of receivables and the percentage of sales approaches for estimating uncollectible accounts.

-

In order to get an idea on current buying trends, a real estate agent collects data on 10 recent house sales in the area. Specifically, she notes the number of bedrooms in each house as follows: a....

-

Your client, Ecru Limited, uses a small sales force to solicit sales of its whole sale restaurant supplies. Ecru is based in State W, and the sales representatives are assigned territories in States...

-

Your client, Royal Corporation, generates significant interest income from its working capital liquid investments. Write a memo for the tax research file, discussing the planning opportunities...

-

Your client, Royal Corporation, generates significant interest income from its working capital liquid investments. Write a memo for the tax research file, discussing the planning opportunities...

-

Javier is currently paying $1,200 in interest on his credit cards annually. If, instead of paying interest, he saved this amount every year, how much would he accumulate in a tax-deferred account...

-

Your company is considering the purchase of a fleet of cars for $195,000. It can borrow at 6%. The cars will be used for four years. At the end of four years they will be worthless. You call a...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

Study smarter with the SolutionInn App