In 2015, Bertha Jarow (head of household with three dependents) had a $28,000 loss from the sale

Question:

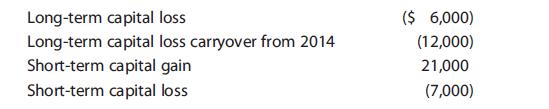

In 2015, Bertha Jarow (head of household with three dependents) had a $28,000 loss from the sale of a personal residence. She also purchased from an individual inventor for $7,000 (and resold in two months for $18,000) a patent on a rubber bonding process. The patent had not yet been reduced to practice. Bertha purchased the patent as an investment. In addition, she had the following capital gains and losses from stock transactions:

What is Bertha’s net capital gain or loss? Draft a letter to Bertha explaining the tax treatment of the sale of her personal residence. Assume that Bertha’s income from other sources puts her in the 28% bracket. Bertha’s address is 1120 West Street, Ashland, OR 97520.

Step by Step Answer:

South Western Federal Taxation 2016 Individual Income Taxes

ISBN: 9781305393301

39th Edition

Authors: James H. Boyd, William H. Jr. Hoffman, David M. Maloney, William A. Raabe, James C. Young