In each of the following independent situations, determine the valuation to be used for estate tax purposes

Question:

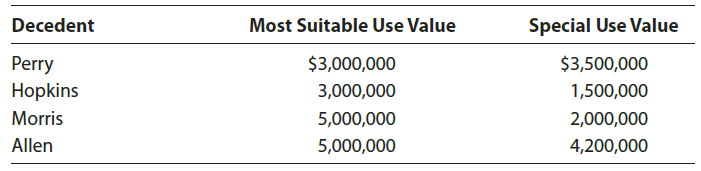

In each of the following independent situations, determine the valuation to be used for estate tax purposes if ? 2032A is elected. All deaths occurred in 2019.

Transcribed Image Text:

Most Suitable Decedent Special Use Value Use Value Perry Hopkins $3,000,000 $3,500,000 3,000,000 1,500,000 Morris Allen 2,000,000 5,000,000 5,000,000 4,200,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 92% (14 reviews)

Presuming the 2032A election otherwise is allowed the v...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2020 Corporations, Partnerships, Estates And Trusts

ISBN: 9780357109168

43rd Edition

Authors: William A. Raabe, James C. Young, William H. Hoffman, Annette Nellen, David M. Maloney

Question Posted:

Students also viewed these Business questions

-

In each of the following independent situations, determine the tentative minimum tax. Assume that the company is not in small corporation status. AMTI (before the Exemption Amount) Quincy Corporation...

-

In each of the following independent situations, determine the dividends received deduction. Assume that none of the corporate shareholders owns 20% or more of the stock in the corporations paying...

-

In each of the following independent situations, determine the corporations income tax liability. Assume that all corporations use a calendar year for tax purposes and that the tax year involved is...

-

Explain why some conditions on the market are regarded as anomalies and explain how that affects factor investing.

-

Discuss some of the design guidelines that relate to the production of parts from ceramic material.

-

what ways do NoSQL databases diverge from traditional relational databases, and what are the implications for scalability and schema flexibility in distributed systems ?

-

Surprising? You are getting to know your new roommate, assigned to you by the college. In the course of a long conversation, you find that both of you have sisters named Deborah. Should you be...

-

Simon Products uses both special journals and a general journal as described in this chapter. Simon also posts customers? accounts in the accounts receivable subsidiary ledger. The postings for the...

-

Leonardo, who is married but files separately, earns $ 8 0 , 0 0 0 of taxable income. He also has $ 1 5 , 0 0 0 in city of Tulsa bonds. His wife, Theresa, earns $ 5 0 , 0 0 0 of taxable income. If...

-

iCover produces bags for carrying laptop computers. iCover sells 1,000,000 units each year at a price of $20 per unit and a contribution margin of 40%. To respond to customer complaints, iCover's...

-

During 2019, Vasu wants to take advantage of the annual exclusion and make gifts to his 6 married children (including their spouses) and his 12 minor grandchildren. a. How much property can Vasu give...

-

Bill and Ellen are husband and wife with five married children and eight grandchildren. Commencing in December 2019, they would like to transfer a tract of land (worth $1.2 million) equally to their...

-

If a companys board of directors wants management to maximize shareholder wealth, should the CEOs compensation be set as a fixed dollar amount, or should the compensation depend on how well the firm...

-

Micro-Brush requires a new component for their laptop cleaning machines. The company must decide whether to make or buy them. If it decides to make them. Should it use process A or process B? Use a...

-

Moving from a fee-for-service to a managed care delivery system set up a series of expectations (page 421). How many of these expectations are realistic? How many have been realized?

-

2. A 55 kg human is shot out the end of a cannon with a speed of 18 m/s at an angle of 60. Ignore friction and solve this problem with energy conservation. As he exits the cannon, find: a. horizontal...

-

Theoretical Background: Information Assurance (IA) architecture also known as security architecture is about planning, integrating and continually monitoring the resources of an organization so they...

-

AZCN recommends Microsoft Lens or Adobe Scan; download one of these to yo phone via your phone's app store 2. Place the document you want to scan on a flat, well-lit surface. Make sure the document...

-

For the following exercises, use properties of logarithms to evaluate without using a calculator. 6log(2) + log, (64) 3logg (4)

-

The first national bank pays a 4% interest rate compound continuously. The effective annual rate paid by the bank is __________. a. 4.16% b. 4.20% c. 4.08% d. 4.12%

-

Determine whether the following expenditures by Cuckoo Corporation are organizational expenditures, startup expenditures, or neither. a. Legal expenses incurred for drafting the corporate charter and...

-

When are C corporations required to make estimated tax payments? How are these payments calculated?

-

When are C corporations required to make estimated tax payments? How are these payments calculated?

-

ABC Corporation has an activity - based costing system with three activity cost pools - Machining, Setting Up , and Other. The company's overhead costs, which consist of equipment depreciation and...

-

Consolidated Balance Sheets - USD ( $ ) $ in Thousands Dec. 3 1 , 2 0 2 3 Dec. 3 1 , 2 0 2 2 Current assets: Cash and cash equivalents $ 9 8 , 5 0 0 $ 6 3 , 7 6 9 Restricted cash 2 , 5 3 2 Short -...

-

How does corporate governance contribute to investor confidence and stakeholder trust? Accounting

Study smarter with the SolutionInn App