Larry plans to gift his daughter $25,000 during the current taxable year. Further, provided she graduates from

Question:

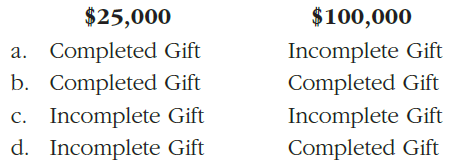

Larry plans to gift his daughter $25,000 during the current taxable year. Further, provided she graduates from a four-year accredited college, he will also gift her $100,000. Which of the following is correct with regard to these gifts during thecurrent year, assuming the cash is given to his daughter in the current year and shedoes not graduate from a four-year accredited college in the current year?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2020 Corporations, Partnerships, Estates And Trusts

ISBN: 9780357109168

43rd Edition

Authors: William A. Raabe, James C. Young, William H. Hoffman, Annette Nellen, David M. Maloney

Question Posted: