Linda, who files as a single taxpayer, had AGI of $280,000 for 2022. She incurred the following

Question:

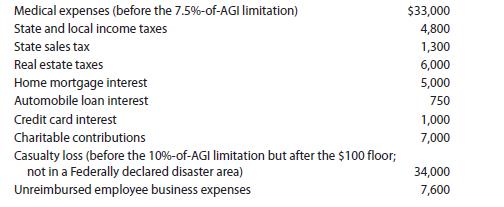

Linda, who files as a single taxpayer, had AGI of $280,000 for 2022. She incurred the following expenses and losses during the year:

Calculate Linda’s allowable itemized deductions for the year.

Transcribed Image Text:

Medical expenses (before the 7.5%-of-AGI limitation) State and local income taxes State sales tax Real estate taxes Home mortgage interest Automobile loan interest Credit card interest Charitable contributions Casualty loss (before the 10%-of-AGI limitation but after the $100 floor; not in a Federally declared disaster area) Unreimbursed employee business expenses $33,000 4,800 1,300 6,000 5,000 750 1,000 7,000 34,000 7,600

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Lindas itemized deductions are computed as follows The aut...View the full answer

Answered By

Khurram shahzad

I am an experienced tutor and have more than 7 years’ experience in the field of tutoring. My areas of expertise are Technology, statistics tasks I also tutor in Social Sciences, Humanities, Marketing, Project Management, Geology, Earth Sciences, Life Sciences, Computer Sciences, Physics, Psychology, Law Engineering, Media Studies, IR and many others.

I have been writing blogs, Tech news article, and listicles for American and UK based websites.

4.90+

5+ Reviews

17+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Linda, who files as a single taxpayer, had AGI of $280,000 for 2018. She incurred the following expenses and losses during the year: Medical expenses (before the 75%-of-AGI limitation)...

-

Linda, age 37, who files as a single taxpayer, had AGI of $280,000 for 2018. She incurred the following expenses and losses during the year: Medical expenses (before the 7.5%-of-AGI limitation) ...

-

Linda, who files as a single taxpayer, had AGI of $280,000 for 2017. She incurred the following expenses and losses during the year: Medical expenses (before the 10%-of-AGI limitation)...

-

Factor completely. p(p + 2) + p(p + 2) - 6(p + 2)

-

What DFD characteristics does an analyst examine when evaluating DFD quality?

-

Name and define two types of interference.

-

3 Identify personal qualities which would help a newcomer to quickly adjust to living and working in a foreign country. Give reasons for your choice.

-

Kahil Mfg. makes skateboards and uses a weighted average process costing system. On May 1, 2013, the company had 400 boards in process that were 70 percent complete as to material and 85 percent...

-

You have been asked to prepare a December cash budget for Ashton Company, a distributor of exercise equipment. The following information is available about the company's operations: a . The cash...

-

After telling your friends how much you are learning in your tax class, one couple has asked you to prepare their individual tax return for them. Being as generous as you are, you agree. So, you are...

-

Alice J. and Bruce M. Byrd are married taxpayers who file a joint return. Their Social Security numbers are 123-45-6784 and 111-11-1113, respectively. Alices birthday is September 21, 1974, and...

-

Evan is single and has AGI of $277,300 in 2022. His potential itemized deductions before any limitations for the year total $52,300 and consist of the following: After all necessary adjustments are...

-

1. What is the current price per camera in $ USD for the Shinko Electric offer? What costs, responsibilities, and risks does MegaShop (the buyer) assume under CPT, Port of Long Beach? 2. What is the...

-

What Is Chemical Energy? Definition and Examples

-

The fundamental concern of computer science is determining what can and cannot be automated. The earliest foundations of what would become computer science predate the invention of the modern digital...

-

History of the United States

-

United States History Pearl Harbor attack

-

During 2017, Aubergine Co. borrowed cash from Chartreuse Company by issuing notes payable as follows: 1. July 1, 2017, issued an eight-month, 4% note for $75,000. Interest and principal are payable...

-

A woman at a point A on the shore of a circular lake with radius 2 mi wants to arrive at the point C diametrically opposite on the other side of the lake in the shortest possible A time. She can walk...

-

One of the key concepts in fiduciary income taxation is that of distributable net income (DNI). List the major functions of DNI on one PowerPoint slide, with no more than five bullets, to present to...

-

One of the key concepts in fiduciary income taxation is that of distributable net income (DNI). List the major functions of DNI on one PowerPoint slide, with no more than five bullets, to present to...

-

One of the key concepts in fiduciary income taxation is that of distributable net income (DNI). List the major functions of DNI on one PowerPoint slide, with no more than five bullets, to present to...

-

Series of Compound Interest Techniques The following are several situations involving compound interest. Required: Using the appropriate table, solve each of the following: ( Click here to access the...

-

If Clark Kelly has recognized gain on an exchange of like-kind property held for investment use, where does Clark report the gain? First on Form 8824, then carried to Schedule D. First on Form 8824,...

-

An investor put 40% of her money in Stock A and 60% in Stock B. Stock A has a beta of 1.2 and Stock B has a beta of 1.6. If the risk-free rate is 5% and the expected return on the market is 12%,...

Study smarter with the SolutionInn App