Manish is a student who began working part-time as a restaurant waiter in October of 20X14. He

Question:

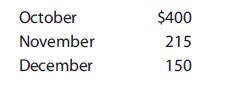

Manish is a student who began working part-time as a restaurant waiter in October of 20X14. He earned the following tips in 20X14, with each month’s tips reported in a schedule submitted to the restaurant’s management by the 10th of the following month:

In addition, Manish received a scholarship in 20X14 which provided $5,000 for tuition, $5,000 for room and board, $1,000 for travel to study abroad, and $1,000 for books.

What total amount from the above should be included in Manish’s 20X14 gross income?

a. $5,765

b. $5,615

c. $6,615

d. $6,765

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2016 Individual Income Taxes

ISBN: 9781305393301

39th Edition

Authors: James H. Boyd, William H. Jr. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted: