On June 1, 2014, Skylark Enterprises (not a corporation) acquired a retail store building for $500,000 (with

Question:

On June 1, 2014, Skylark Enterprises (not a corporation) acquired a retail store building for $500,000 (with $100,000 being allocated to the land). The store building was 39-year real property, and the straight-line cost recovery method was used. The property was sold on June 21, 2018, for $385,000.

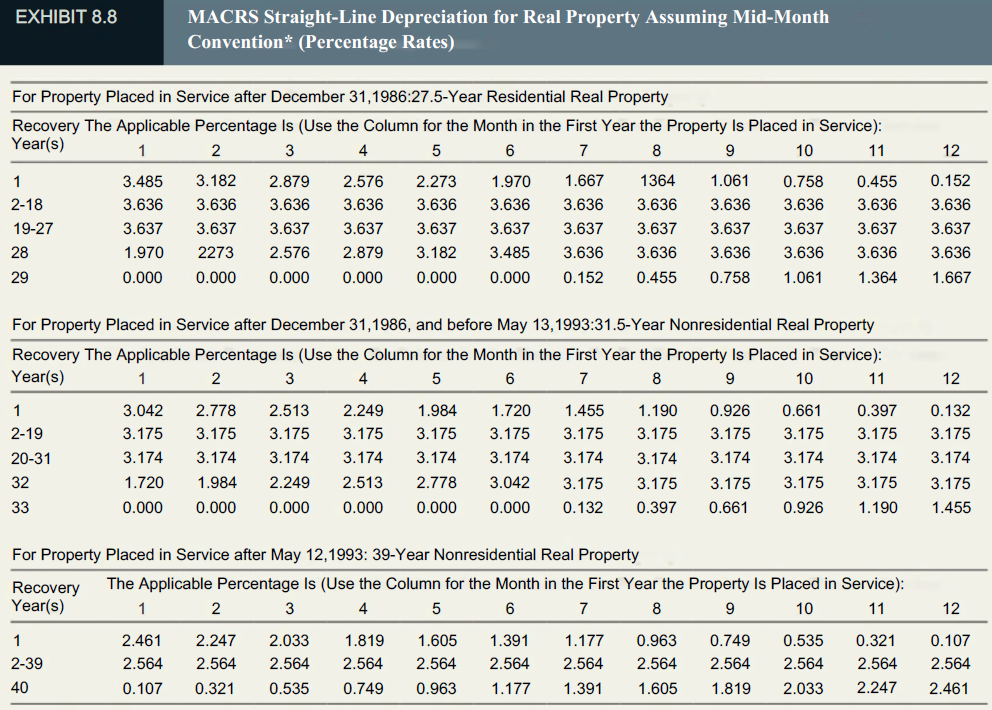

a. Compute the cost recovery and adjusted basis for the building using Exhibit 8.8 from Chapter 8.

b. What are the amount and nature of Skylark's gain or loss from disposition of the property? What amount, if any, of the gain is un-recaptured § 1250 gain?

Transcribed Image Text:

EXHIBIT 8.8 MACRS Straight-Line Depreciation for Real Property Assuming Mid-Month Convention* (Percentage Rates) For Property Placed in Service after December 31,1986:27.5-Year Residential Real Property Recovery The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service): Year(s) 2 3 8 10 11 12 3.485 3.182 1.970 1.667 1364 1.061 0.152 2.879 2.576 2.273 0.758 0.455 2-18 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 19-27 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 28 1.970 2273 2.576 2.879 3.182 3.485 3.636 3.636 3.636 3.636 3.636 3.636 29 0.000 0.000 0.000 0.000 0.000 0.000 0.152 0.455 0.758 1.061 1.667 1.364 For Property Placed in Service after December 31,1986, and before May 13,1993:31.5-Year Nonresidential Real Property Recovery The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service): Year(s) 2 3 6. 8 9. 10 11 12 4 5 1.984 3.042 2.778 2.513 2.249 1.720 1.455 1.190 0.926 0.661 0.397 0.132 2-19 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.174 3.174 3.174 3.174 3.174 3.174 3.174 3.174 3.174 3.174 3.174 3.174 20-31 1.720 1.984 3.042 32 2.249 2.513 2.778 3.175 3.175 3.175 3.175 3.175 3.175 1.190 33 0.000 0.000 0.000 0.000 0.000 0.000 0.132 0.661 0.926 1.455 0.397 For Property Placed in Service after May 12,1993: 39-Year Nonresidential Real Property The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service): Recovery Year(s) 3 8 10 11 12 4 2.461 2.247 2.033 1.819 1.605 1.391 0.963 0.749 0.535 0.321 0.107 1.177 2-39 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 40 2.247 0.107 0.321 0.535 0.749 0.963 1.177 1.391 1.605 1.819 2.033 2.461

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 77% (9 reviews)

a b Selling price 385000 Adjusted basis 358968 100000 458968 Re...View the full answer

Answered By

Mugdha Sisodiya

My self Mugdha Sisodiya from Chhattisgarh India. I have completed my Bachelors degree in 2015 and My Master in Commerce degree in 2016. I am having expertise in Management, Cost and Finance Accounts. Further I have completed my Chartered Accountant and working as a Professional.

Since 2012 I am providing home tutions.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2019 Comprehensive

ISBN: 9781337703017

42th Edition

Authors: David M. Maloney, William A. Raabe, William H. Hoffman, James C. Young

Question Posted:

Students also viewed these Business questions

-

On May 2, 1988, Hannah Weather (Social Security number: 111-22- 3333) acquired residential real estate for $450,000. Of the cost, $100,000 was allocated to the land and $350,000 to the building. On...

-

Your supervisor at your CPA firm has questioned whether the depreciation taken on a building under I68(k) is subject to 1250 depreciation recapture. Find a discussion in the Form 4797 instructions...

-

Which of the following taxpayers may claim a deduction for qualified business income? Explain. a. A driver for Uber or Lyft. b. A veterinarian operating as an S corporation. In addition to veterinary...

-

Calculate the standard entropy change for the following reactions at 25C. Comment on the sign of r S. (a) 2 Al(s) + 3 Cl 2 (g) 2 AlCl 3 (s) (b) 2 CH 3 OH() + 3 O 2 (g) 2 CO 2 (g) + 4 H 2 O(g)

-

Let A be a nonempty set and fix the set B, where B A. Define the relation R on P(A) by X R Y, for X, Y A, if B X = B Y. (a) Verify that R is an equivalence relation on P(A). (b) If A = {1, 2, 3}...

-

With the given sets of components, find R and . Rx = 5.18, R y = 8.56

-

Restate the difference between real and personal property, and give five hospitality examples of each. AppendixLO1

-

Read the case XYZ Company: An Integrated Capital Budgeting Instructional Case and answer the following question: Should the replacement asset be purchased? That is, does it make economic (financial)...

-

Entries for Treasury Stock On May 27, Hydro Clothing Inc. reacquired 65,000 shares of its common stock at $6 per share. On August 3, Hydro Clothing sold 48,000 of the reacquired shares at $9 per...

-

John and Martha Holloway are married filing jointly. They are 35 and 31 years old, respectively. Their address is 10010 Dove Street, Atlanta, GA 30294. Additional information about Mr. and Mrs....

-

On December 1, 2016, Lavender Manufacturing Company (a corporation) purchased another company's assets, including a patent. The patent was used in Lavender s manufacturing operations; $49,500 was...

-

Larry is the sole proprietor of a trampoline shop. During 2018, the following transactions occurred: Unimproved land adjacent to the store was condemned by the city on February 1. The condemnation...

-

Multiple Choice Questions 1. Which of the following statements is true with respect to when a product should be dropped? a. A product should be dropped when fixed costs avoided are less than the...

-

n1 = 15, n2 = 18, S = 280, H1: m1 > m2. Exercises 57 present sample sizes and the sum of ranks for the rank-sum test. Compute S, S, and the value of the test statistic z. Then find the P-value.

-

n1 = 25, n2 = 32, S = 850, H1: m1 m2. Exercises 57 present sample sizes and the sum of ranks for the rank-sum test. Compute S, S, and the value of the test statistic z. Then find the P-value.

-

Evaluate the matrix element $\left\langle j_{1} j_{2} J\left|T_{k q}(1) ight| j_{1}^{\prime} j_{2}^{\prime} J^{\prime} ightangle$, where the tensor operator $T_{k q}(1)$ operates only on the part of...

-

Mark Gold opened Gold Roofing Service on April 1. Transactions for April are as follows: 1 Gold contributed \(\$ 15,000\) of his personal funds in exchange for common stock to begin the business. 2...

-

n1 = 20, n2 = 30, S = 400, H1: m1 < m2. Exercises 57 present sample sizes and the sum of ranks for the rank-sum test. Compute S, S, and the value of the test statistic z. Then find the P-value.

-

What is the effect of pH on the separation of amino acids by electrophoresis? Why?

-

Find the radius of convergence in two ways: (a) Directly by the CauchyHadamard formula in Sec. 15.2. (b) From a series of simpler terms by using Theorem 3 or Theorem 4.

-

Velocity, Inc., a foreign corporation, operates a U.S. branch. It reports the following tax results and other information for the year. Pretax earnings effectively connected with a U.S. trade or...

-

Velocity, Inc., a foreign corporation, operates a U.S. branch. It reports the following tax results and other information for the year. Pretax earnings effectively connected with a U.S. trade or...

-

Emma, a U.S. resident, received the following income items for the current tax year. Identify the source of each income item as either U.S. or foreign. a. $600 interest from a savings account at a...

-

Your company BMG Inc. has to liquidate some equipment that is being replaced. The originally cost of the equipment is $120,000. The firm has deprecated 65% of the original cost. The salvage value of...

-

1. What are the steps that the company has to do in time of merger transaction? And What are the obstacle that may lead to merger failure? 2.What are the Exceptions to not to consolidate the...

-

Problem 12-22 Net Present Value Analysis [LO12-2] The Sweetwater Candy Company would like to buy a new machine that would automatically "dip" chocolates. The dipping operation currently is done...

Study smarter with the SolutionInn App