On September 18, 2018, Gerald received land and a building from Frank as a gift. Frank's adjusted

Question:

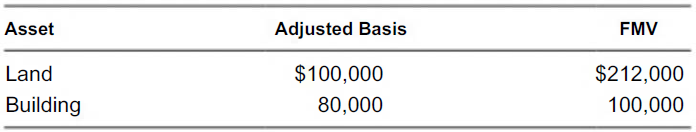

On September 18, 2018, Gerald received land and a building from Frank as a gift. Frank's adjusted basis and the fair market value at the date of the gift are as follows:

No gift tax was paid on the transfer.

a. Determine Gerald’s adjusted basis for the land and building.

b. Assume instead that the fair market value of the land was $87,000 and that of the building was $65,000. Determine Gerald s adjusted basts for die land and building.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2019 Comprehensive

ISBN: 9781337703017

42th Edition

Authors: David M. Maloney, William A. Raabe, William H. Hoffman, James C. Young

Question Posted: