Phil and Susan Hammond are married taxpayers filing a joint return. The couple have two dependent children.

Question:

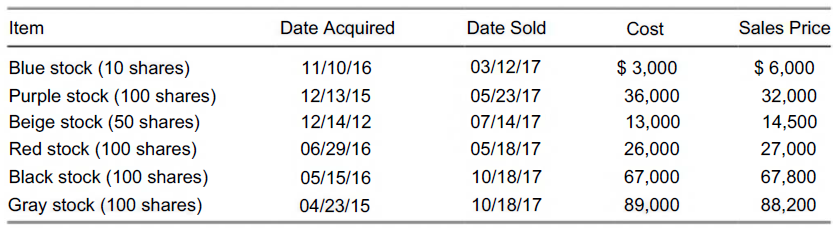

Phil and Susan Hammond are married taxpayers filing a joint return. The couple have two dependent children. Susan has wages of $34,000 in 2017. Phil does not work due to a disability, but he is a buyer and seller of stocks. He generally buys and holds for long-term gain, but occasionally gets in and out of a stock quickly. The couple’s 2017 stock transactions are detailed below. In addition, they have $2,300 of qualifying dividends.

a. What is Phil and Susan’s AGI?

b. Complete a Form 8949 for the Hammonds (Phil’s Social Security number is 123-45-6789). Assume that the stock sale information was reported to die Hammonds on a Form 1099-B and that basis information was provided to the IRS.

Step by Step Answer:

South-Western Federal Taxation 2019 Comprehensive

ISBN: 9781337703017

42th Edition

Authors: David M. Maloney, William A. Raabe, William H. Hoffman, James C. Young