Pickle, a U.S. citizen, died this year. Earlier this year, Pickle made taxable gifts of $290,000 that

Question:

Transcribed Image Text:

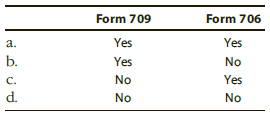

Form 709 Form 706 Yes Yes a. b. Yes No Yes No C. d. No No

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (15 reviews)

Form 709 ...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted:

Students also viewed these Business questions

-

Maria Martinez died in 2015, survived by her spouse, Sergio, and two adult children. Her gross estate, all of which passed under her will, was valued at $7.2 million. She had Sec. 2053 deductions of...

-

Joseph Jernigan died in 2015 with a taxable estate of $4.1 million. He was survived by his spouse Josephine and several children. He made taxable gifts of $100,000 in 1974 and $650,000 in 2000. The...

-

Martinez died in 2016, survived by her spouse, Sergio, and two adult children. Her gross estate, all of which passed under her will, was valued at $7.2 million. She had Sec. 2053 deductions of...

-

1. Determine and confirm purchasing requirements for at least six (6) of the goods listed in the knowledge evidence. 2.Make purchase arrangements for the goods to meet different: End product...

-

Look again at Solved Problem 29.3, where the saving and investment equation S = I + NX is derived. In deriving this equation, we assumed that national income was equal to Y. But Y only includes...

-

Provide reasons for countries to use export subsidies. Does your answer depend on whether firms compete under perfect or imperfect competition? LO.1

-

7. Suppose that f : R2 -+ R2 has continuous first-order partial derivatives in some ball Br(xo, Yo), r > o. Prove that if 6. j (xo, Yo) i= 0, then 8f11 (f( )) = 8h/8y(xo, Yo) uJ;lX xo, Yo tA.. ..J(....

-

Chicago Supply Company manufactures paper clips and other office products. Although inexpensive, paper clips have provided the firm with a high margin of profitability. Sample size is 200. Results...

-

Depreciation is a method of cost allocation, not valuation. What does this mean?

-

Do research to find the total worldwide sales for hard disk drives and solid state storage devices over a five-year or more period. Try to get figures for the number of units sold as well as total...

-

Tom and AliceHoneycutt, ages 35 and 36, respectively, live at 101 Glass Road, Delton,MI 49046. Tom is a county employee, and Alice is a self-employed accountant. Toms Social Security number is...

-

Show that x(t) and x (t) are orthogonal for the following signals: (a) x 1 (t) = sin ( 0 t) (b) x 2 (t) = 2cos ( 0 t) + sin ( 0 t) cos (2 0 t) (c) x 3 (t) = A exp (j 0 t)

-

Refer to Exercise 5-24 for data. Now assume that Dexter Company uses the sequential method to allocate support department costs to the producing departments. Human resources is allocated first in the...

-

Revisits scope, time, and cost baselines in the context of agile methodologies. Because agile includes several methodologies (like Scrum, Kanban, Extreme Programming, Feature-Driven Development) we...

-

Background information and task: Fed officials divided in July over need for more rate hikes, minutes show WASHINGTON, Aug 16 (Reuters) - Federal Reserve officials were divided over the need for more...

-

Questions: 1. What are the long-term prospects for the Chinese market? 2. Does it make sense for GM to produce automobiles for the Chinese market in China? Why? 3. What do you think would happen if...

-

The purpose of this assignment is to apply your knowledge of conflict management to a real-world situation so that you can enhance your skills in handling conflicts. It is crucial to carefully read...

-

Roy's Toys received a shipment of 100,000 rubber duckies from the factory. The factory couldn't promise that all rubber duckies are in perfect form, but they promised that the percentage of defective...

-

Locate the given numbers in the complex plane. 3j

-

Evaluate the function at the given value(s) of the independent variable. Simplify the results. (x) = cos 2x (a) (0) (b) (- /4) (c) (/3) (d) ()

-

Sunset Corporation, with E & P of $400,000, makes a cash distribution of $120,000 to a shareholder. The shareholder's basis in the Sunset stock is $50,000. a. Determine the tax consequences to the...

-

Pursuant to a complete liquidation, Carrot Corporation distributes to its share holders real estate held as an investment (basis of $650,000, fair market value of $880,000). a. Determine the gain or...

-

Pursuant to a complete liquidation, Carrot Corporation distributes to its share holders real estate held as an investment (basis of $650,000, fair market value of $880,000). a. Determine the gain or...

-

American Food Services, Incorporated leased a packaging machine from Barton and Barton Corporation. Barton and Barton completed construction of the machine on January 1 , 2 0 2 4 . The lease...

-

Which of the following statements is true? Financial measures tend to be lag indicators that report on the results of past actions. LA profit center is responsible for generating revenue, but it is...

-

Andretti Company has a single product called a Dak. The company normally produces and sells 8 0 , 0 0 0 Daks each year at a selling price of $ 5 6 per unit. The company s unit costs at this level of...

Study smarter with the SolutionInn App