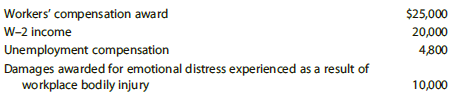

Pierce, a married individual, received the following in 2017: Considering only the above, what is Pierces 2017

Question:

Considering only the above, what is Pierce€™s 2017 gross income?

a. $49,800

b. $34,800

c. $30,000

d. $24,800

Transcribed Image Text:

Workers' compensation award W-2 income Unemployment compensation Damages awarded for emotional distress experienced as a result of workplace bodily injury $25,000 20,000 4,800 10,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (8 reviews)

Answered By

Richa Goel

I am mcom and ugc net qualified in commerce and english expert. I am a pgt teacher.

0.00

0 Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2018 Essentials Of Taxation Individuals And Business Entities

ISBN: 9781337386173

21st Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted:

Students also viewed these Business questions

-

1. Walters, an individual, received the following in 2017: W-2 income .......................................................................... $10,000 Federal tax refund for 2016...

-

Cole, a 48-year-old married individual, received the following in 2016: S corporation stock dividends...............................................................$5,000 Interest earned on federal...

-

Cole, a 48-year-old married individual, received the following in 2017: S corporation stock dividends ............................................................ $5,000 Interest earned on federal...

-

In Table 12. 1, when r = 0. 02, the present value of the cost rises for 68 years and then subsequently declines. Why? Table 12. 1 TABLE 12.1 Economic Harvesting Decision: Douglas Fir 10 20 30 40 50...

-

A biologist has a 40% solution and a 10% solution of the same plant nutrient. How many cubic centimeters of each solution should be mixed to obtain 25 cc of a 28% solution?

-

Draw a graph of Marcs budget line with the quantity of movie tickets on the x -axis. What is the slope of Marcs budget line? What determines its value? Marc has a budget of $20 a month to spend on...

-

Cards You are dealt a hand of five cards from a standard deck of playing cards. Find the probability of being dealt a hand consisting of (a) four-of-a-kind. (b) a full house, which consists of three...

-

The Draper Clinic has two general practitioners who see patients daily. An average of 6.5 patients arrives at the clinic per hour (Poisson distributed). Each doctor spends an average of 15 minutes...

-

Diversified Semiconductors sells perishable electronic components. Some must be shipped and stored in reusable protective containers. Customers pay a deposit for each container received. The deposit...

-

Roberta Santos, age 41, is single and lives at 120 San-borne Avenue, Springfield, IL 60781. Her Social Security number is 123-45-6789. Roberta has been divorced from her former husband, Wayne, for...

-

The following pertain to Joyce in 2017: What total amount from the above may be excluded from Joyces 2017 gross income? a. $5,650 b. $350 c. $5,150 d. $850 Medical insurance premiums paid by employer...

-

Cole, a 48-year-old married individual, received the following in 2017: In addition, Cole spent $500 on lottery scratch-off cards in 2017. All of the cards were losers except for one, from which Cole...

-

Annular packed beds (APBs) involving the flow of fluids are used in many technical and engineering applications, such as in chemical reactors, heat exchangers, and fusion reactor blankets. It is well...

-

Zephyr Minerals completed the following transactions involving machinery. Machine No. 1550 was purchased for cash on April 1, 2020, at an installed cost of $75,000. Its useful life was estimated to...

-

Kelly is a self-employed tax attorney whose practice primarily involves tax planning. During the year, she attended a three-day seminar regarding new changes to the tax law. She incurred the...

-

At a recently concluded Annual General Meeting (AGM) of a company, one of the shareholders remarked; historical financial statements are essential in corporate reporting, particularly for compliance...

-

4. In hypothesis, Mr. Ng wants to compare the solution in Q3 to other solutions in different conditions. If the following constraints are newly set in place, answer how much different is going to be...

-

3C2H6O2+7H2O= C2H4O3+11H2+O2+H2C2O4+CH2O2 Glycolic acid is produced electrochemically from ethylene glycol under alkaline conditions(NaOH). Hydrogen is produced at the cathode, and formic acid and...

-

Choose your own company and repeat the analysis from Problems 1 and 2. Get the data from Yahoo! Finance at https://finance.yahoo.com/. To retrieve the data for your company, enter the name or ticker...

-

Economic feasibility is an important guideline in designing cost accounting systems. Do you agree? Explain.

-

In the current year, Paul Chaing (4522 Fargo Street, Geneva, IL 60134) acquires a qualifying historic structure for $350,000 (excluding the cost of the land) and plans to substantially rehabilitate...

-

Tom, a calendar year taxpayer, informs you that during the year, he incurs expenditures of $40,000 that qualify for the incremental research activities credit. In addition, it is determined that his...

-

Tom, a calendar year taxpayer, informs you that during the year, he incurs expenditures of $40,000 that qualify for the incremental research activities credit. In addition, it is determined that his...

-

3. The nominal interest rate compounded monthly when your $7,000 becomes $11,700 in eight years is ________

-

An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 21% and a standard deviation of return of 39%. Stock B has an expected return of 14% and a...

-

Advanced Small Business Certifica Drag and Drop the highlighted items into the correct boxes depending on whether they increase or decrease Alex's stock basis. Note your answers- you'll need them for...

Study smarter with the SolutionInn App