Rod Clooney purchases Kayla Mitchells sole proprietorship for $990,000 on August 15, 2022. The assets of the

Question:

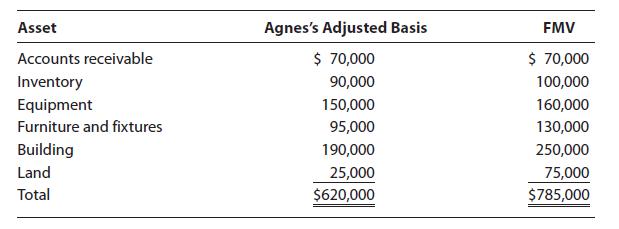

Rod Clooney purchases Kayla Mitchell’s sole proprietorship for $990,000 on August 15, 2022. The assets of the business are:

a. Calculate Kayla’s realized and recognized gain.

b. Determine Rod’s basis for each of the assets.

c. Write a letter to Rod informing him of the tax consequences of the purchase. His address is 300 Riverview Drive, Delaware, OH 43015.

Transcribed Image Text:

Asset Accounts receivable Inventory Equipment Furniture and fixtures Building Land Total Agnes's Adjusted Basis $ 70,000 90,000 150,000 95,000 190,000 25,000 $620,000 FMV $ 70,000 100,000 160,000 130,000 250,000 75,000 $785,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

a Kayla reports gains andor losses for each asset sold to Rod following the procedures of IRC 1060 T...View the full answer

Answered By

Ashish Bhalla

I have 12 years work experience as Professor for Accounting, Finance and Business related subjects also working as Online Tutor from last 8 years with highly decentralized organizations. I had obtained a B.Com, M.Com, MBA (Finance & Marketing). My research interest areas are Banking Problem & Investment Management. I am highly articulate and effective communicator with excellent team-building and interpersonal skills; work well with individuals at all levels.

4.80+

17+ Reviews

46+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Rod Clooney purchases Agnes Mitchell's sole proprietorship for $990,000 on August 15, 2015. The assets of the business are as follows: Rod and Agnes agree that $50,000 of the purchase price is for...

-

Rod Clooney purchases Agnes Mitchells sole proprietorship for $990,000 on August 15, 2017. The assets of the business are as follows: a. Calculate Agness realized and recognized gain. b. Determine...

-

Rod Clooney purchases Agnes Mitchell's sole proprietorship for $990,000 on August 15, 2016. The assets of the business are as follows: a. Calculate Agnes's realized and recognized gain. b. Determine...

-

Monochromatic light from a distant source is incident on a slit 0.750mm wide. On a screen 2.00 m away, the distance from the central maximum of the diffraction pattern to the first minimum is...

-

Using the direct method, prepare the statement of cash flows for the year ended June 30,2011. GECKO INC. Comparative Balance Sheets June 30,2011 and 2010 2011 2010 GECKO INC. Income Statement For...

-

The managers of Martin House are paid a salary and share in a bonus that is determined at the end of each year. The total bonus is determined by multiplying the companys income from operations by 25...

-

Explain how the four Is of services would apply to a Marriott Hotel.

-

Define each of the following terms: a. Annual report; balance sheet; income statement b. Common stockholders equity, or net worth; retained earnings c. Statement of retained earnings; statement of...

-

Question 35 3.33 pts French Horn Company forgot to record accrued income tax expense of $27.500 at the end of the period. The failure to record income tax would result in an: Overstatement of assets....

-

Mike Bradys spouse died five years ago. Mike is 40 years old, and he has three boys, Greg, Peter, and Bobby. The three boys (his sons) live with Mike for more than half of the year. Greg is 15, Peter...

-

Mahan purchases 1,000 shares of Bluebird Corporation stock on October 3, 2022, for $300,000. On December 12, 2022, Mahan purchases an additional 750 shares of Bluebird stock for $210,000. According...

-

Zoe purchases Tan, Inc. bonds for $108,000 on January 2, 2022. The face value of the bonds is $100,000; the maturity date is December 31, 2026; and the annual interest rate is 5%. Zoe will amortize...

-

(i) Suppose that L is a finite language whose words are w 1 , w 2 , w 3 , , w 83 . Prove that there is a TG that accepts exactly the language L. (ii) Of all TGs that accept exactly the language L,...

-

Moving Inc. wants to develop an activity flexible budget for the activity of moving materials. Moving Inc. uses forklifts to move materials from receiving to storeroom and then to production. The...

-

We are in the tail end of Quarter 3 earnings reporting season in the U.S. markets. Roughly 60 percent of companies that have reported their Q3 earnings so far have reported negative earnings relative...

-

Below is a running shock tube illustration. 0.1 0.0 | 0.0 4 4 Diaphragm 1 0.5 Image: Shock tube Initial setup 1 3 2 1 Expansion Head Expansion Tail Slip Shock Surface Image: Running Shock Tube...

-

As you may remember, Holiday Tree Services, Inc. (HTS) has recently entered into a contract with Delish Burger (Delish), whereby HTS is to supply and decorate a Christmas tree in each of Delish...

-

Understanding various types of leadership styles is important in order to determine personal leadership styles. Reflection: Answer both Compare and contrast 2 leadership styles. State the...

-

What are some typical supplier rewards and punishments that a buyer could use? If you work for a company, describe how it rewards and punishes its suppliers. Do you think appropriate methods are...

-

Avatar Financials, Inc., located on Madison Avenue, New York City, is a company that provides financial advice to individuals and small- to mid-sized businesses. Its primary operations are in wealth...

-

Compare the cash and accrual methods of accounting for the following events: a. Purchased new equipment, paying $50,000 cash and giving a note payable for $30,000 due next year. b. Paid $3,600 for a...

-

Compare the cash and accrual methods of accounting for the following events: a. Purchased new equipment, paying $50,000 cash and giving a note payable for $30,000 due next year. b. Paid $3,600 for a...

-

Compare the cash and accrual methods of accounting for the following events: a. Purchased new equipment, paying $50,000 cash and giving a note payable for $30,000 due next year. b. Paid $3,600 for a...

-

Assignment Title: The Role of Bookkeeping in Business Management and Financial Reporting Objective: Understand the importance of proper bookkeeping procedures in the management of...

-

17) The adjustment that is made to allocate the cost of a building over its expected life is called:A) depreciation expense.B) residual value.C) accumulated depreciation.D) None of the above answers...

-

9) Prepaid Rent is considered to be a(n):A) liability.B) asset.C) contra-asset.D) expense.10) As Prepaid Rent is used, it becomes a(n):A) liability.B) expense. C) contra-asset.D) contra-revenue.11)...

Study smarter with the SolutionInn App