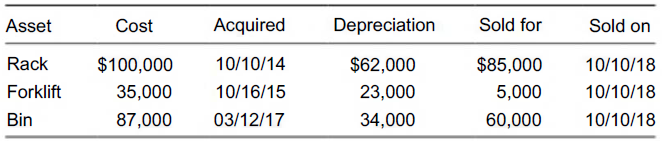

Siena Industries (a sole proprietorship) sold three 1231 assets during 2018. Data on these property dispositions

Question:

Siena Industries (a sole proprietorship) sold three § 1231 assets during 2018. Data on these property dispositions are as follows:

a. Determine the amount and the character of the recognized gain or loss from the disposition of each asset.

b. Assuming that Siena has no non-recaptured net § 1231 losses from prior years, analyze these transactions and determine the amount (if any) that will be treated as a long-term capital gain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2019 Comprehensive

ISBN: 9781337703017

42th Edition

Authors: David M. Maloney, William A. Raabe, William H. Hoffman, James C. Young

Question Posted: