Wesley and Myrtle (ages 90 and 88, respectively) live in an assisted care facility and for years

Question:

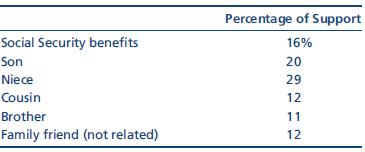

Wesley and Myrtle (ages 90 and 88, respectively) live in an assisted care facility and for years 2013 and 2014 received their support from the following sources.

a. Who is eligible to claim the Federal income tax dependency exemptions under a multiple support agreement?

b. Must Wesley and Myrtle be claimed as dependents by the same person(s) for both 2013 and 2014? Explain.

c. Who, if anyone, can claim an itemized deduction for paying the medical expenses of Wesley and Myrtle?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2015

ISBN: 9781305310810

38th Edition

Authors: William H. Hoffman, William A. Raabe, David M. Maloney, James C. Young

Question Posted: