Based on the facts and results of Problem 30 and the beginning-of-the-year book-tax basis differences listed below,

Question:

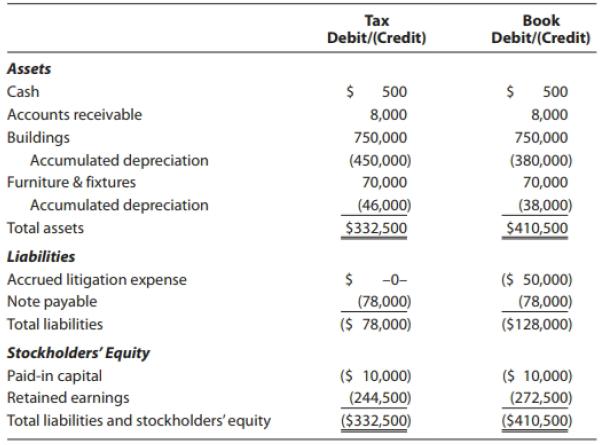

Based on the facts and results of Problem 30 and the beginning-of-the-year book-tax basis differences listed below, determine the change in Relix's deferred tax liabilities for the current year.

Beginning of Year

Building—accumulated depreciation ........................... ($57,000)

Furniture & fixtures—accumulated depreciation ........ (4,200)

Subtotal ............................................................................ ($61,200)

Applicable tax rate ......................................................... x 21%

Gross deferred tax liability ......................................... ($12,852)

Data from Problem 30

Step by Step Answer:

South-Western Federal Taxation 2019 Essentials Of Taxation Individuals And Business Entities

ISBN: 9781337702966

22nd Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, David M. Maloney