In each of the following independent situations, determine the corporations income tax liability. Assume that all corporations

Question:

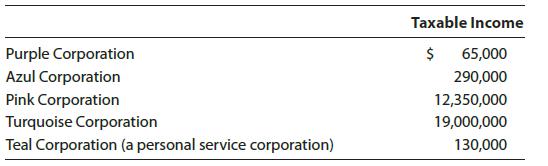

In each of the following independent situations, determine the corporation’s income tax liability. Assume that all corporations use a calendar year for tax purposes and that the tax year involved is 2021.

Transcribed Image Text:

Purple Corporation Azul Corporation Pink Corporation Turquoise Corporation Teal Corporation (a personal service corporation) Taxable Income $ 65,000 290,000 12,350,000 19,000,000 130,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

A flat rate of 21 applies to all C corporations including PSC...View the full answer

Answered By

Aysha Ali

my name is ayesha ali. i have done my matriculation in science topics with a+ . then i got admission in the field of computer science and technology in punjab college, lahore. i have passed my final examination of college with a+ also. after that, i got admission in the biggest university of pakistan which is university of the punjab. i am studying business and information technology in my university. i always stand first in my class. i am very brilliant client. my experts always appreciate my work. my projects are very popular in my university because i always complete my work with extreme devotion. i have a great knowledge about all major science topics. science topics always remain my favorite topics. i am also a home expert. i teach many clients at my home ranging from pre-school level to university level. my clients always show excellent result. i am expert in writing essays, reports, speeches, researches and all type of projects. i also have a vast knowledge about business, marketing, cost accounting and finance. i am also expert in making presentations on powerpoint and microsoft word. if you need any sort of help in any topic, please dont hesitate to consult with me. i will provide you the best work at a very reasonable price. i am quality oriented and i have 5 year experience in the following field.

matriculation in science topics; inter in computer science; bachelors in business and information technology

_embed src=http://www.clocklink.com/clocks/0018-orange.swf?timezone=usa_albany& width=200 height=200 wmode=transparent type=application/x-shockwave-flash_

4.40+

11+ Reviews

14+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Corporations, Partnerships, Estates And Trusts

ISBN: 9780357519240

45th Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman

Question Posted:

Students also viewed these Business questions

-

In each of the following independent situations, determine the corporation's income tax liability. Assume that all corporations use a calendar year for tax purposes and that the tax year involved is...

-

In each of the following independent situations, determine the corporations income tax liability. Assume that all corporations use a calendar year for tax purposes and that the tax year involved is...

-

a. In each of the following independent situations, determine the corporations income tax liability. Assume that all corporations use a calendar year for tax purposes and that the tax year involved...

-

As an HR director for IMF Plastics Manufacturing, you receive a phone call about communicating changes made by the company to provide additional shifts.As soon as the call ends, you begin the process...

-

Compute index numbers for the following data using 1997 as the baseyear. Year 1997 1998 1999 2000 2001 2002 2003 2004 2005 Quantity 2073 2290 2349 2313 2456 2508 2463 2499 2520 Year 2006 2007 2008...

-

Required information The following information applies to the questions displayed below.] Brooke, a single taxpayer, works for Company A for all of 2019, earning a salary of $75,000. a. What is her...

-

12. Unrealized profit in the ending inventory is eliminated in consolidation workpapers by increasing cost of sales and decreasing the inventory account. How is unrealized profit in the beginning...

-

Appelpolscher has just left a meeting with Stella J. Smarly, IGC?s vice-president for Process Operations and Development. Smarly is concerned about an upcoming extended plant test of a method...

-

You have just purchased an 4.65%, 15-year bond that was issued originally on August 31, 2015. It has a yield to maturity of 2.55% and duration of 7.29 years. If the market yield changes by 25 basis...

-

Determine the factor of safety of the retaining wall shown in Figure P17.3 with respect to overturning, sliding, and bearing capacity failure. Given: unit weight of concrete = 24.0 kN/m 3 , ' = 2/3',...

-

Which of the following C corporations will be allowed to use the cash method of accounting for 2021? Explain your answers. a. Jade Corporation, which had gross receipts of $26,300,000 in 2018,...

-

Assume the same facts as in Problem 37, except that the business is a specified services business (e.g., a consulting firm) owned equally by Elliot and Conrad (an unrelated individual) in a...

-

Calculating and interpreting the debt ratio a. Compute the debt ratio for each of the three companies. b. Which company has the most financial leverage? Expenses Total Assets Net Income $ 40,000...

-

Thomson Company's income statement for the year ended December 31, 20X4, reported net income of $360,000. The financial statements also disclosed the following information: Depreciation $60,000...

-

Based on past experience, Maas Corporation (a U.S.-based company) expects to purchase raw materials from a foreign supplier at a cost of 1,800,000 francs on March 15, 2024. To hedge this forecasted...

-

Suppose that laws are passed banning labor unions and that resulting lower labor costs are passed along to consumers in the form of lower prices. Assume that the U.S. economy was in long-run...

-

What's wrong with the following statement? "Because the digits 0, 1, 2,....9 are the normal results from lottery drawings, such randomly selected numbers have a normal distribution." Choose the...

-

Matching Question Drag and drop various responsibilities of employers that are related to workplace values against the corresponding values. Drag and drop application. Justice Justice drop zone...

-

Identify whether each of the following compounds is chiral or achiral: a. b. c. d. e. f. g. h. i. j. k. l. m. n. o. p. CI

-

At 31 December 20X9, the end of the annual reporting period, the accounts of Huron Company showed the following: a. Sales revenue for 20X9, $ 2,950,000, of which one- quarter was on credit. b....

-

Matthew owns an insurance policy (face amount of $500,000) on the life of Emily with Lily as the designated beneficiary. If Emily dies first and the $500,000 is paid to Lily, how much as to this...

-

Carl made the following transfers during the current year. Transferred $900,000 in cash and securities to a revocable trust, life estate to him- self and remainder interest to his three adult...

-

Regarding the formula for the Federal gift tax (see Concept Summary 18.1 in the text), comment on the following observations. a. A credit is allowed for the gift taxes actually paid on prior gifts....

-

Which of the following statements is true? Financial measures tend to be lag indicators that report on the results of past actions. LA profit center is responsible for generating revenue, but it is...

-

Andretti Company has a single product called a Dak. The company normally produces and sells 8 0 , 0 0 0 Daks each year at a selling price of $ 5 6 per unit. The company s unit costs at this level of...

-

What are the major characteristics of plant assets? Choose one category of PP&E (land, land improvements, buildings or equipment) and describe the costs that may be capitalized with this asset.

Study smarter with the SolutionInn App