Tom and Gail form Owl Corporation with the following consideration: The installment note has a face amount

Question:

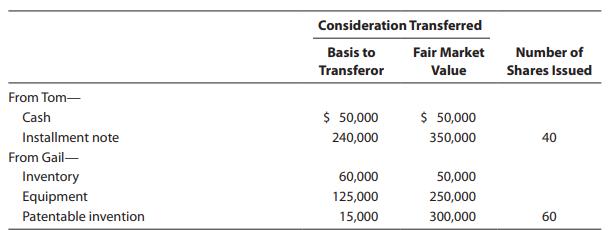

Tom and Gail form Owl Corporation with the following consideration:

The installment note has a face amount of $350,000 and was acquired last year from the sale of land held for investment purposes (adjusted basis of $240,000). As to these transactions, provide the following information:

a. Tom’s recognized gain or loss.

b. Tom’s basis in the Owl Corporation stock.

c. Owl Corporation’s basis in the installment note.

d. Gail’s recognized gain or loss.

e. Gail’s basis in the Owl Corporation stock.

f. Owl Corporation’s basis in the inventory, equipment, and patentable invention.

g. How would your answers to the preceding questions change if Tom received common stock and Gail received preferred stock?

h. How would your answers change if Gail was a partnership?

i. Gail is considering an alternative to the plan as presented above. She is considering selling the inventory to an unrelated third party for $50,000 in the current year instead of contributing it to Owl. After the sale, she will transfer the $50,000 sales proceeds along with the equipment and patentable invention to Owl for 60 shares of Owl stock. Whether or not she pursues the alternative, she plans to sell her Owl stock in six years for an anticipated sales price of $700,000. In present value terms and assuming she later sells her Owl stock, determine the tax cost of (1) contributing the property as originally planned or (2) pursuing the alternative she has identified. Referring to Appendix G, assume a discount rate of 6%. Further, assume Gail’s marginal income tax rate is 32% and her capital gains rate is 15%.

j. Prepare your solution to part (i) using spreadsheet software such as Microsoft Excel.

Discount RateDepending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Step by Step Answer:

South-Western Federal Taxation 2020 Comprehensive

ISBN: 9780357109144

43rd Edition

Authors: David M. Maloney, William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman