Rebecca Downs, CPA, is doing the audit of Berlup Gun and Rack Shop, a national wholesaler of

Question:

Rebecca Downs, CPA, is doing the audit of Berlup Gun and Rack Shop, a national wholesaler of rifles and related equipment and supplies. She is surprised at the results found in the testing to this point in sales and sales returns. There are large numbers of errors in the sales tests, which were done using a judgmental sample. There are a variety of types of errors, including pricing, extensions, footings, failure to record, and duplicate recording in sales returns and postings to subsidiary records. The confirmation of accounts receivable also indicates numerous errors. Upon analysis of the errors, she concludes that the problem is extremely sloppy bookkeeping rather than intentional errors.

When Downs informs management of the problem, she is told that they are not too surprised. Customers have been complaining about their bills in recent months, and the bookkeeper has been having personal problems. He has now been discharged, and the company is in the process of hiring a new bookkeeper. The owner states that he does not feel the problem is serious from a financial statement point of view, because the errors mostly offset each other.

Downs is not convinced that the problem of overall financial statement errors is as minor as the owner states. She decides that additional confirmation of accounts receivable is required under the circumstances. Further thought leads her to conclude that there are two problems: The positive confirmation response has been only approximately 25% to 30% in the past, and it is now 45 days after the balance sheet date. After considerable deliberation, Downs decides to select a combined sample of sales and sales returns and determine the effect of the errors on net sales and earnings. She has concluded that a misposting of a sale or return to the wrong customer is not an error, because gross sales are correctly stated. The owner assures Downs that failure to bill a customer even for a period of several months is not likely to make the receivable uncollectible.

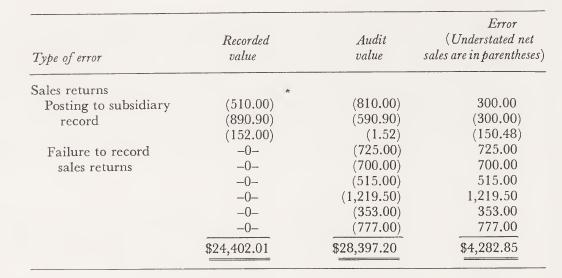

Total recorded sales amount to \($14,625,416\), and recorded returns are \($1,421,711\). Downs concludes that an error of \($200,000\) affecting net earnings would be material. She decides to use a Beta risk of 10% and an Alpha of 100%. She has no basis for estimating the standard deviation or a point estimate. She decides to select 100 items to calculate these two figures.

The sales invoices for the year started with 18,624 and ended with 32,041. They are recorded in the sales journal in the order of issue rather than sequentially. Sales returns and allowances, which are sequentially recorded in the returns journal, start with 671 and end with 3,621.

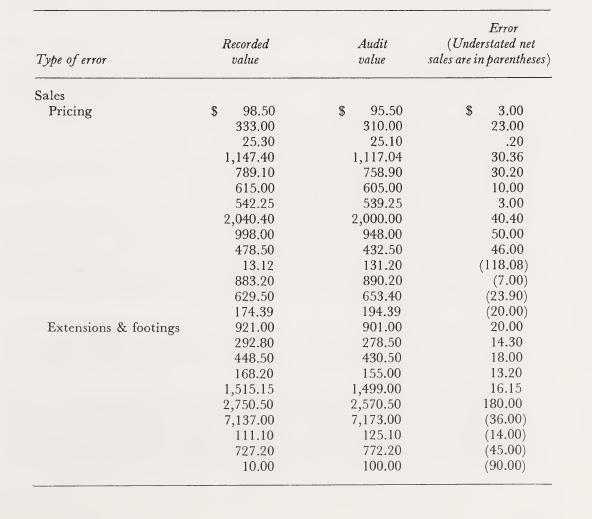

Based upon the sample size of 100 items, of which 26 were sales returns and allowances, the following error information was noted:

The value of the 68 items in the sample that have no errors is \($77,280\). The sum of these items squared is SI04,830,000.

Required:

a. Evaluate the approach Downs is taking.

b. Explain how she should select the random numbers using a random number table.

c. Calculate the confidence limits for the population of sales and sales returns combined using ratio estimation.

d. How large would the sample need to be to meet Downs’ confidence limits requirements ?

e. What would the confidence limits be if all errors were included except for the failure to record sales returns errors? Why is the difference between your answers in c and e so large ?

f. Suggest a strategy for Downs to follow at this point.

Step by Step Answer:

Applications Of Statistical Sampling To Auditing

ISBN: 9780130391568

1st Edition

Authors: Alvin A. Arens, James K. Loebbecke