You are responsible for the 12/31/8X audit of Reynolds Jewelry Company, a medium-sized manufacturer of custom jewelry.

Question:

You are responsible for the 12/31/8X audit of Reynolds Jewelry Company, a medium-sized manufacturer of custom jewelry. This is the second year of the engagement, but the first year in which attributes sampling is to be used.

Engagement planning, including internal control evaluation, began on 9/15/8X. The internal control questionnaire and flowcharts have been updated. Weaknesses of internal control and control areas on which you intend to rely have been identified. In this case, you are to concern yourself only with acquisi¬ tions and payments and related balance sheet accounts.

The material internal control weaknesses in acquisitions and payments have been identified as follows.

(1) There are no subsidiary records for accounts payable. Transactions are first recorded when payment is made for an acquisition. Owing to a cash shortage, there are large numbers of unpaid invoices at any given time.

(2) Signed checks are returned to the accountant. The accountant reviews all checks before they are submitted to the president for his signature, and reviews all recorded disbursement transactions.

(3) The bank account is reconciled by the accountant.

(4) Documents are marked “paid” before they are signed by the owner. No date or check number is included on the documents.

(5) Checks are not recorded sequentially in the cash disbursements journal. This arises because checks are prepared at the time vendors’ invoices and receiving reports are matched.

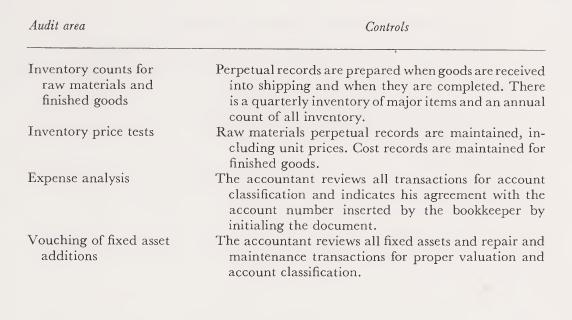

The significant controls the auditor plans to rely on are as follows:

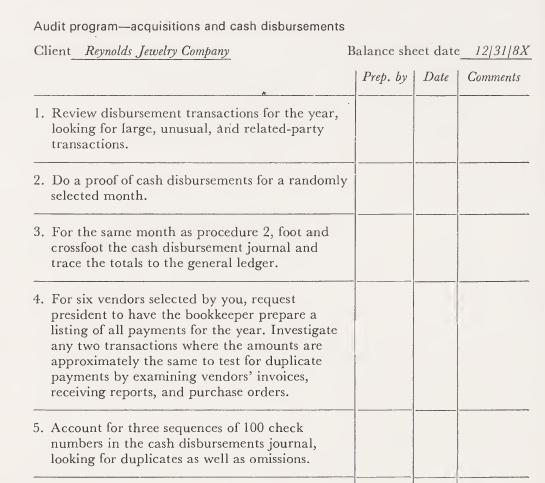

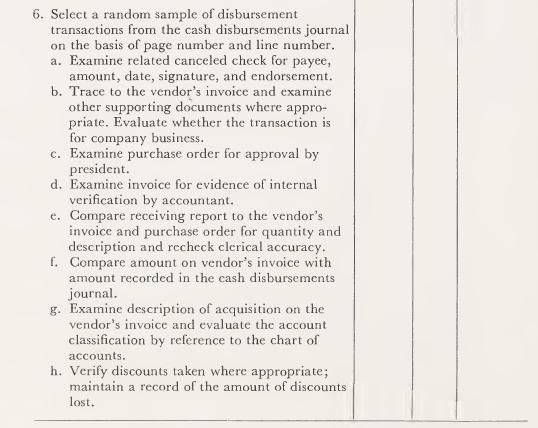

The acquisition and payment tests of transactions audit program was developed after considering:

(1) Normal audit objectives that are fulfilled by tests of transactions (2) Weaknesses in the system that can most efficiently be tested by tests of transactions (3) Controls the auditor intends to rely on that can most efficiently be tested by tests of transactions The audit program, attributes sampling data sheet, error analysis schedule, and internal control memo are included in the following pages. The random selection and worksheet documentation are not a part of this case.

Required :

a. Evaluate the audit program, given the weaknesses in internal control and the controls the auditor intends to rely on.

b. Evaluate the completed attributes sampling data sheet for completeness and adequacy. Include in your evaluation the appropriateness of the defined objectives, sampling unit, and attributes being used. Also evaluate the confidence level and desirable upper precision limit used.

c. What is your opinion of testing the population for only 11 months ? Support your conclusion.

d. Evaluate the need for an error analysis schedule. Evaluate the conclusions drawn on the schedule included.

e. Evaluate the need for an internal control memo. Evaluate the adequacy of the memo included.

f. To what degree do you believe the system can be relied on to reduce audit tests in those areas where reliance was intended?

Step by Step Answer:

Applications Of Statistical Sampling To Auditing

ISBN: 9780130391568

1st Edition

Authors: Alvin A. Arens, James K. Loebbecke