Your client, Dowlray Motor Co., is a small, one-plant operation that manufactures only motors for large boats,

Question:

Your client, Dowlray Motor Co., is a small, one-plant operation that manufactures only motors for large boats, but in numerous shapes and models. The company, following the lead of the larger firms in the industry, several years ago converted from FIFO to LIFO for its raw-materials, work-in-process, and finished-goods inventories.

Your responsibility is to compute the LIFO valuation to be used for valuing the raw-materials portion of the inventory. Since the company is largely an assembler of parts acquired from other manufacturers, the raw materials consist of easily identifiable, completed parts, well organized in the company’s single warehouse.

You determine there are 14,326 items listed in the client’s FIFO inventory listing, with unit costs ranging from a few cents to just under SI,000. The book value of the raw-materials inventory was \($4,560,640\) at the balance sheet date.

You are satisfied, based on normal audit tests not involving statistical methods, that the book value of inventory at FIFO is fairly stated.

You have been instructed to first determine the difference between the recorded and LIFO values for each sample item. The estimated total adjustment is calculated by multiplying the population size by the average value of the difference. The inventory valuation for financial statement purposes is determined by subtracting the estimated total adjustment from the recorded value. Your firm has decided that the inventory value should not be misstated by more than SI20,000 at a confidence level of 95%.

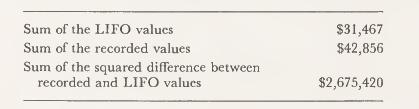

You take a preliminary random sample of 100 items and calculate the LIFO valuation for each item. The following are the results of the sample:

Required :

a. Determine the LIFO inventory valuation at a 95% confidence level based on the sample size of 100 items.

b. Explain why it would not be appropriate to adjust the recorded value to LIFO by the amount of the estimated total adjustment.

c. Determine the appropriate total sample size for determining the estimated total adjustment.

d. Evaluate whether unstratified difference estimation is an appropriate statistical method in this situation.

Step by Step Answer:

Applications Of Statistical Sampling To Auditing

ISBN: 9780130391568

1st Edition

Authors: Alvin A. Arens, James K. Loebbecke