Casual Furniture World has had numerous inquiries regarding the availability of furniture and equipment that could be

Question:

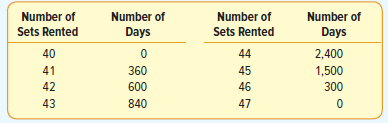

An investigation revealed that most people interested in renting wanted a complete group of party essentials (about 12 chairs, four tables, a deluxe grill, a bottle of propane gas, tongs, etc.). Management decided not to buy a large number of complete sets because of the financial risk involved. That is, if the demand for the rental groups was not as large as anticipated, a large financial loss might be incurred. Further, outright purchase would mean that the equipment would have to be stored during the off-season. It was then discovered that a firm in Boston leased a complete party set for $560 for the summer season. This amounts to about $5 a day. In the promotional literature from the Boston firm, a rental fee of $15 was suggested. For each set rented, a profit of $10 would thus be earned. It was then decided to lease from the Boston firm, at least for the first season. The Boston firm suggested that, based on the combined experience of similar rental firms in other cities, either 41, 42, 43, 44, 45, or 46 complete sets be leased for the season. Based on this suggestion, management must now decide on the most profitable number of complete sets to lease for the season. The leasing firm in Boston also made available some additional information gathered from several rental firms similar to the newly formed subsidiary. Note in the following table (which is based on the experience of the other rental firms) that for 360 days of the total of 6,000 days€™ experience€”or about 6% of the days€”these rental firms rented out 41 complete party sets. On 10% of the days during a typical summer, they rented 42 complete sets, and so on.

a. Construct a payoff table. (As a check figure, for the act of having 41 complete sets available and the event of renting 41, the payoff is $410.)

b. The expected daily profit for leasing 43 complete sets from the Boston firm is $426.70; for 45 sets, $431.70; and for 46 sets, $427.45. Organize these expected daily profits into a table, and complete the table by finding the expected daily profit for leasing 41, 42, and 44 sets from the Boston firm.

c. On the basis of the expected daily profit, what is the most profitable action to take?

d. The expected opportunity loss for leasing 43 party sets from the Boston firm is $11.60; for 45 sets, $6.60; for 46 sets, $10.85. Organize these into an expected opportunity loss table, and complete the table by computing the expected opportunity loss for 41, 42, and 44.

e. According to the expected opportunity loss table, what is the most profitable course of action to take? Does this agree with your decision for part (c)?

f. Determine the expected value of perfect information. Explain what it indicates in this problem.

Step by Step Answer:

Statistical Techniques in Business and Economics

ISBN: 978-1259666360

17th edition

Authors: Douglas A. Lind, William G Marchal