Mr. Montero is deciding how to invest the money for his sons tuition, which is due 2

Question:

Mr. Montero is deciding how to invest the money for his son’s tuition, which is due 2 months from today. He can put the money in a 2-month certificate of deposit (CD) earning a 10%annual rate of interest, or he can put the money in a 1-month CD now and earn 9 %. If he puts the money in the 1-month CD, then a month later he will have to invest it in another 1-month CD. The rate 1 month from today is uncertain. Both CDs are protected by FDIC insurance. Assume that Mr. Montero knows the 1-month rate in the next month follows a normal distribution with a mean of 11 % and a standard deviation of 2 %. What will be his choice if he is a risk averter? What will be his choice if he is risk-neutral?

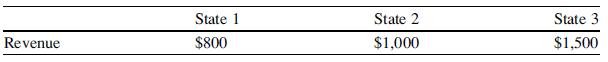

Use the following information to answer questions 53–55. Ms. Jones is thinking of investing in a new project that will cost $1,000 to start. There are two ways to raise this $1,000. She can take out $1,000 from her own pocket or take out $500 and invite a friend to share the investment. The investment will generate the following revenues, depending on the outcome of the investment.

The revenue will be equally split between Ms. Jones and her friend if they share the project. It is estimated that the probabilities of states 1, 2, and 3 are 1/3, 1/3, and 1/3, respectively.

Step by Step Answer:

Statistics For Business And Financial Economics

ISBN: 9781461458975

3rd Edition

Authors: Cheng Few Lee , John C Lee , Alice C Lee