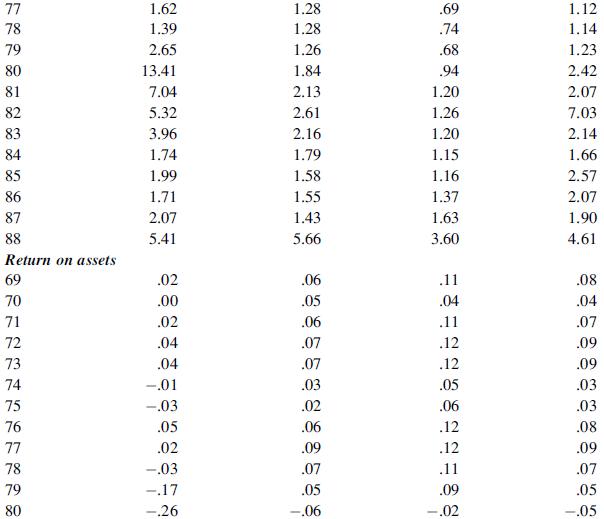

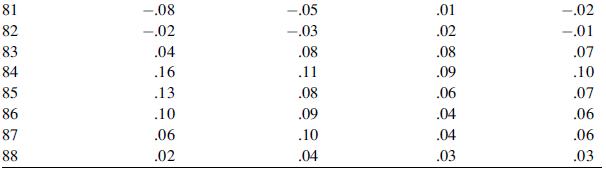

Redo question 42 using the data for GM. Question 42 Estimate the regression of Chryslers return on

Question:

Redo question 42 using the data for GM.

Question 42

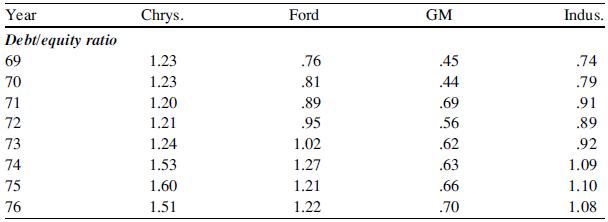

Estimate the regression of Chrysler’s return on assets against its debt/equity ratio. Compute the Durbin–Watson statistic. Does autocorrelation exist?

Use MINITAB and the Above information to answer question. To find out whether there is a relationship between the amount of financial leverage a firm uses and the return on the firm’s assets, you collect information on the debt/equity ratio and return on assets for the “big three” automakers and the average for the auto industry.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Statistics For Business And Financial Economics

ISBN: 9781461458975

3rd Edition

Authors: Cheng Few Lee , John C Lee , Alice C Lee

Question Posted: