(7) A company has just received some state-of-the-art electronic equipment from an overseas supplier. The packaging has...

Question:

(7) A company has just received some ‘state-of-the-art’ electronic equipment from an overseas supplier. The packaging has been damaged during delivery and the company must decide whether to accept the equipment. If the equipment itself has not been damaged, it could be sold for a profit of $10 000. However, if the batch is accepted and it turns out to be damaged, a loss of − $5000 will be made. Rejection of the equipment will lead to no change in the company’s profit. After a cursory inspection, the company’s engineer estimates that there is a 60% chance that the equipment has not been damaged. The company has another option. The equipment could be tested by a local specialist company. Their test, however, is not perfectly reliable and has only an 80% chance of giving a correct indication.

How much would it be worth paying for the information from the test? (Assume that the company’s objective is to maximize expected profit.)

(8) The managers of Red Valley Auto Products are considering the national launch of a new car-cleaning product. For simplicity, the potential average sales of the product during its lifetime are classified as being either high, medium or low and the net present value of the product under each of these conditions is estimated to be $80 million, $15 million and − $40 million , respectively. The company’s marketing manager estimates that there is a 0.3 probability that average sales will be high, a 0.4 probability that they will be medium and a 0.3 probability that they will be low. It can be assumed that the company’s objective is to maximize expected net present value.

(a) On the basis of the marketing manager’s prior probabilities, determine:

(i) Whether the product should be launched.

(ii) The expected value of perfect information.

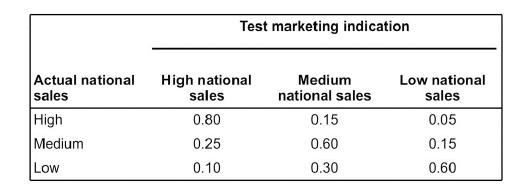

(b) The managers have another option. Rather than going immediately for a full national launch they could first test market the product in their Northern sales region. This would obviously delay the national launch, and this delay, together with other outlays associated with the test marketing, would lead to costs having a net present value of $3 million. The test marketing would give an indication as to the likely success of the national launch, and the reliability of each of the possible indications which could result is shown by the conditional probabilities in the table below (e.g., if the market for the product is such that high sales could be achieved there is a probability of 0.15 that test marketing would in fact indicate only medium sales):

Calculate the expected value of imperfect information and hence determine whether the company should test market the product.

Step by Step Answer:

Decision Analysis For Management Judgment

ISBN: 9781118740736,9781118889251

5th Edition

Authors: Paul Goodwin , George Wright