A mortgage loan approval process consists of three steps in series performed by clerks A, B, and

Question:

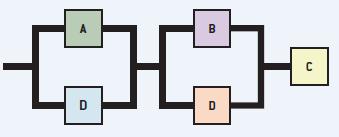

A mortgage loan approval process consists of three steps in series performed by clerks A, B, and C. Errors are often made, and a study found that clerks A and B had an average reliability of only 0.85, which results in the paperwork having errors, missing information, and so on. Clerk C who performs the final review catches nearly all mistakes and has a reliability of 0.99, but the work involved is causing a considerable backlog.

After studying the process, the loan manager decided to add an additional clerk D with more experience to each of the first two steps to check the work, having a reliability of 0.95 as shown in the diagram on the next page.

a. How much does adding this redundancy improve the reliability of the original process?

b. If, in addition to adding clerks D, the reliability of clerks A and B can be improved to 0.95 through better training, how much can the reliability be improved?

Step by Step Answer: