FlexMan has identified a third party that is willing to produce routers and switches as needed. The

Question:

FlexMan has identified a third party that is willing to produce routers and switches as needed. The third party will charge $6 per router and $4 per switch. Assume all other data as in Exercise 4, except that hiring and layoffs are allowed as in Exercise 5.

Data From Exercise 4

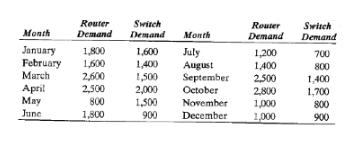

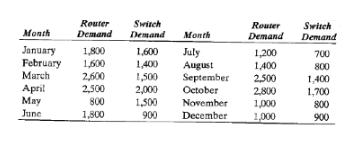

FlexMan, an electronics contract manufacturer, uses its Topeka, Kansas, facility to produce two product categories: routers and switches. Consultation with customers has indicated a demand forecast for each category over the next 12 months (in thousands of units) to be as shown in Table 8-11.

Table 8-11

Manufacturing is primarily an assembly operation, and the number of people on the production line governs capacity. The plant operates 20 days a month, 8 hours each day. Production of a router takes 20 minutes, and production of a switch requires 10 minutes of worker time. Each worker is paid $10 per hour, with a 50 percent premium for any overtime. The plant currently has 6,300 employees. Overtime is limited to 20 hours per employee per month. The plant currently maintains 100,000 routers and 50,000 switches in inventory. The cost of holding a router in inventory is $3 per month, and the cost of holding a switch in inventory is $1 per month. The holding cost arises because products are paid for by the customer at existing market rates when purchased. Thus, if FlexMan produces early and holds in inventory, the company recovers less given the rapidly dropping component prices.

Data From Exercise 5

Reconsider the FlexMan data from Exercise 4. The firm is considering the option of changing workforce size with demand. The cost of hiring a new employee is $700 and the cost of a layoff is $1,000. It takes an employee two months to reach full production capacity. During those two months, a new employee provides only 50 percent productivity. Anticipating a similar demand pattern next year, FlexMan aims to end the year with 6,300 employees.

Data From Exercise 4

FlexMan, an electronics contract manufacturer, uses its Topeka, Kansas, facility to produce two product categories: routers and switches. Consultation with customers has indicated a demand forecast for each category over the next 12 months (in thousands of units) to be as shown in Table 8-11.

Table 8-11

Manufacturing is primarily an assembly operation, and the number of people on the production line governs capacity. The plant operates 20 days a month, 8 hours each day. Production of a router takes 20 minutes, and production of a switch requires 10 minutes of worker time. Each worker is paid $10 per hour, with a 50 percent premium for any overtime. The plant currently has 6,300 employees. Overtime is limited to 20 hours per employee per month. The plant currently maintains 100,000 routers and 50,000 switches in inventory. The cost of holding a router in inventory is $3 per month, and the cost of holding a switch in inventory is $1 per month. The holding cost arises because products are paid for by the customer at existing market rates when purchased. Thus, if FlexMan produces early and holds in inventory, the company recovers less given the rapidly dropping component prices.

Manufacturing is primarily an assembly operation, and the number of people on the production line governs capacity. The plant operates 20 days a month, 8 hours each day. Production of a router takes 20 minutes, and production of a switch requires 10 minutes of worker time. Each worker is paid $10 per hour, with a 50 percent premium for any overtime. The plant currently has 6,300 employees. Overtime is limited to 20 hours per employee per month. The plant currently maintains 100,000 routers and 50,000 switches in inventory. The cost of holding a router in inventory is $3 per month, and the cost of holding a switch in inventory is $1 per month. The holding cost arises because products are paid for by the customer at existing market rates when purchased. Thus, if FlexMan produces early and holds in inventory, the company recovers less given the rapidly dropping component prices.

a. How should FlexMan use the third party if new employees provide only 50 percent productivity for the first two months?

b. How should FlexMan use the third party if new employees are able to achieve full productivity right away?

c. Why does the use of the third party change with the productivity of new employees?

Step by Step Answer:

Supply Chain Management Strategy Planning And Operation

ISBN: 9781292257891

7th Global Edition

Authors: Sunil Chopra