The following excerpt is from Coca-Cola Companys 2017 annual report filed with the SEC: Management evaluates the

Question:

The following excerpt is from Coca-Cola Company’s 2017 annual report filed with the SEC:

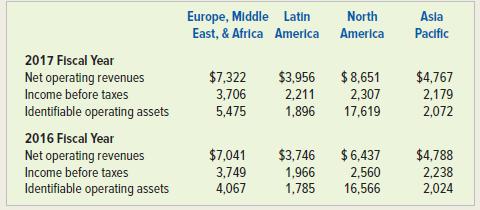

Management evaluates the performance of our operating segments separately to individually monitor the different factors affecting financial performance. Our Company manages income taxes and certain treasury-related items, such as interest income and expense, on a global basis within the Corporate operating segment. We evaluate segment performance based on income or loss before income taxes.*

*2017. Investors Info: SEC Filings. Coca Cola Company.

Selected segment data for Coca-Cola Company for the 2017 and 2016 fiscal years follow. Dollar amounts are in millions.

Required

a. Compute the ROI for each of Coke’s geographical segments for each fiscal year. Which segment appears to have the best performance during 2017 based on their ROIs? Which segment showed the most improvement from 2016 to 2017?

b. Assuming Coke’s management expects a minimum return of 30 percent, calculate the residual income for each segment for each fiscal year. Which segment appears to have the best performance based on residual income? Which segment showed the most improvement from 2016 to 2017?

c. Explain why the segment with the highest ROI in 2017 was not the segment with the highest residual income.

d. Assume the management of Coke is considering a major expansion effort for the next five years. On which geographic segment would you recommend Coke focus its expansion efforts? Explain the rationale for your answer.

Step by Step Answer:

Survey Of Accounting

ISBN: 9781260575293

6th Edition

Authors: Thomas Edmonds, Christopher Edmonds, Philip Olds