Go to the IRS website at www.irs.gov and print Form 4562. Using the following information, complete this

Question:

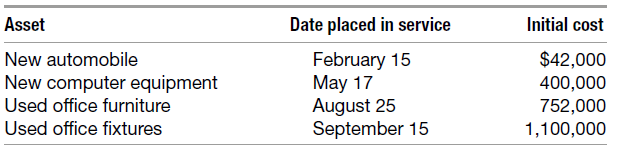

Go to the IRS website at www.irs.gov and print Form 4562. Using the following information, complete this form to the extent possible. Barclays Corporation, a calendar-year taxpayer, had taxable income of $2,000,000 for 2017 before computing its depreciation deduction. It purchased and placed the following business assets in service:

Transcribed Image Text:

Date placed in service Initial cost Asset New automobile New computer equipment Used office furniture Used office fixtures February 15 $42,000 May 17 August 25 400,000 752,000 1,100,000 September 15

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 53% (13 reviews)

Form 4562 Department of the Treasury Internal Revenue Service 99 Names shown on return Barclays Corporation Part I Election To Expense Certain Property Under Section 179 Note If you have any listed pr...View the full answer

Answered By

Muhammad Khurram

I have strong General Management skills to apply in your projects. Over last 3 years, I have acquired great knowledge of Accounting, Auditing, Microsoft Excel, Microsoft PowerPoint, Finance, Microsoft Project, Taxation, Strategic Management, Human Resource, Financial Planning, Business Planning, Microsoft Word, International Business, Entrepreneurship, General Management, Business Mathematics, Advertising, Marketing, Supply Chain, and E-commerce. I can guarantee professional services with accuracy.

4.80+

249+ Reviews

407+ Question Solved

Related Book For

Taxation For Decision Makers 2019

ISBN: 9781119497288

9th Edition

Authors: Shirley Dennis Escoffier, Karen A. Fortin

Question Posted:

Students also viewed these Business questions

-

Go to the IRS Web site (www.irs.gov) and print Form 1040. Using the information in problem 46, complete this form to the extent possible.

-

The exam to become an EA has three parts. Go to the IRS Website at www.irs.gov and determine what is tested on each part of the exam. Describe the content of each part.

-

Go to the IRS Web site at www.irs.govand print Form 4562, Schedule C, Schedule SE, and the first page of Form 1040. Using the information in problem 44, complete these forms to the extent possible...

-

Although illegal, overloading is common in the trucking industry. A state highway planning agency (Minnesota Department of Transportation) monitored the movements of overweight trucks on an...

-

Describe how the articular surfaces of the hip joint are held together.

-

Ammonia forms hydrogen-bonding intermolecular forces resulting in an unusually high boiling point for a substance with the small size of NH 3 . Can hydrazine (N 2 H 4 ) also form hydrogen-bonding...

-

Explain what a demand curve is and the role of revenues in pricing decisions.

-

Refer to RE19-1. Assume that Frankfort's taxable income for Year 1 is $300,000. Prepare the journal entry to record Frankfort Company's income tax expense. In RE19-1, Frankfort Company identifies...

-

Analyze the components of Altmans Z-Score. Suggest at least two decisive measures that a company could take in order to lower its probability of bankruptcy.

-

Overview The milestone for Project One involves applying accounting principles and methods to long-term liabilities and equity. You will also evaluate these financial statement components for...

-

Identify the issues or problems suggested by the following situations. State each issue as a question. Monicon Corporation purchased a $24,000 computer in 2015 and elected to expense it under Section...

-

Maria Sanchez, the sole proprietor of a consulting business, has gross receipts of $720,000 for 2017. Expenses paid by her business are: Advertising...

-

Discuss how changes in income, technology, or other changes in the economic environment may lead to changes in the balance between public and private provision. Illustrate, for instance, by a...

-

Which of the five hazardous attitudes do you display most frequently? What can you do to minimize the presence and impact of these attitudes in your life?

-

What brought you to this course? How do you define Black or Blackness? What do you hope to get out of this class? When you think of Black Culture, what is the first thing that comes to mind? [For...

-

1. What is XBRL Taxonomy? How do you as a preparer of financial statement use the XBRL Taxonomy in locating a label for a specific financial element? 2. What are the benefits of adopting XBRL from...

-

What a business can do to protect and minimize the invasion of privacy for their customers? Think of your experience when visiting a website. What do most websites have you agree to before you do...

-

Based on your interest, skill set, or goals what do you typically contribute when working in groups? What do you need others to contribute due to your lack of interest, skill set, or goals? How do...

-

What does Zach DeGregorio cite as the most beneficial characteristics of using EPS in financial analysis? And the most problematic?

-

Explain how two samples can have the same mean but different standard deviations. Draw a bar graph that shows the two samples, their means an standard deviations as error bars. T S

-

Charles owns a 25 percent interest in Cal Corporation, an S corporation. The corporation has run into some difficulties recently and Charles lent it $10,000. At the beginning of the year, Charles's...

-

Is there any tax advantage to a 100 percent shareholder-employee of an S corporation compared to a shareholder-employee of a C corporation under the following circumstances: shareholder-employee...

-

At the beginning of year 1, Lisa and Marie were equal shareholders in LM Corporation, an S corporation. On April 30, year 1, Lisa sold half of her interest to Shelley. On August 8, year 1, Marie sold...

-

Mediocre Company has sales of $120,000, fixed expenses of $24,000, and a net income of $12,000. If sales rose 10%, the new net income would be: Question 18 options: $16,800 $36,000 $13,200 $15,600

-

1. Why might managers of small restaurants decide not to adopt the standard work hour approach to controlling labour cost? (minimum 150 words )

-

Which statement is true regarding the U.S. GAAP impairment test for limited life intangibles? A. U.S. GAAP impairment is likely to be greater than IFRS impairment. B. The impairment test for limited...

Study smarter with the SolutionInn App