Burbank Corporation (calendar-year end) acquired the following property this year: Burbank acquired the copier in a nontaxable

Question:

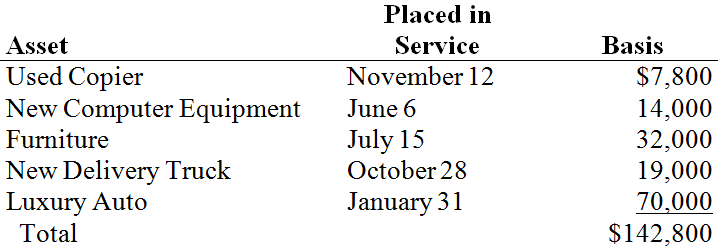

Burbank Corporation (calendar-year end) acquired the following property this year:

Burbank acquired the copier in a nontaxable transaction when the shareholder contributed the copier to the business in exchange for stock.

a) Assuming no bonus or §179 expense, what is Burbank’s maximum cost recovery for this year?

b) Assuming Burbank would like to maximize its cost recovery by electing bonus and §179 expense, which assets should Burbank immediately expense?

c) What is Burbank’s maximum cost recovery this year assuming it elects §179 expense and bonus depreciation?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Taxation Of Individuals And Business Entities 2019 Edition

ISBN: 9781259918391

10th Edition

Authors: Brian C. Spilker, Benjamin C. Ayers, John Robinson, Edmund Outslay, Ronald G. Worsham, John A. Barrick, Connie Weaver

Question Posted: