Euro Corporation, a U.S. corporation, operates through a branch in Germany. During 2022, the branch reported taxable

Question:

Euro Corporation, a U.S. corporation, operates through a branch in Germany. During 2022, the branch reported taxable income of $1,000,000 and paid German income taxes of $300,000. In addition, Euro received $50,000 of dividends from its 5 percent investment in the stock of Maple Leaf Company, a Canadian corporation. The dividend was subject to a withholding tax of $5,000. Euro reported U.S. taxable income from its manufacturing operations of $950,000. Total taxable income was $2,000,000. Pre-credit U.S. taxes on the taxable income were $420,000. Included in the computation of Euro’s taxable income were “definitely allocable” expenses of $500,000, 50 percent of which were related to the German branch taxable income.

Complete pages 1 and 2 of Form 1118 for just the foreign branch income reported by Euro. You can use the fill-in form available on the IRS website, www.irs.gov.

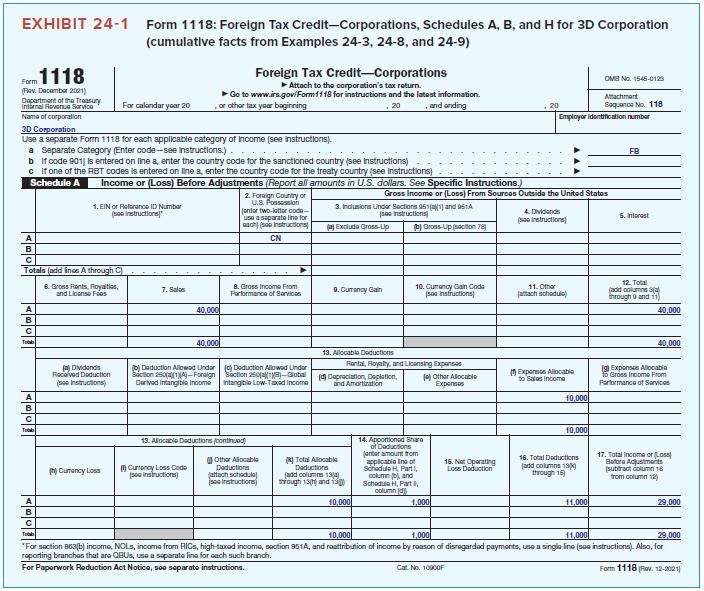

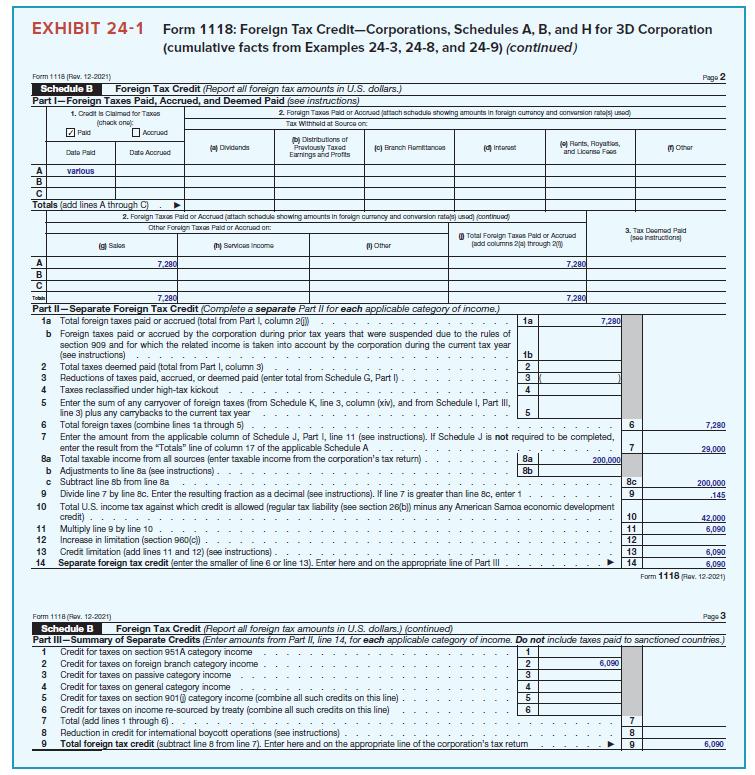

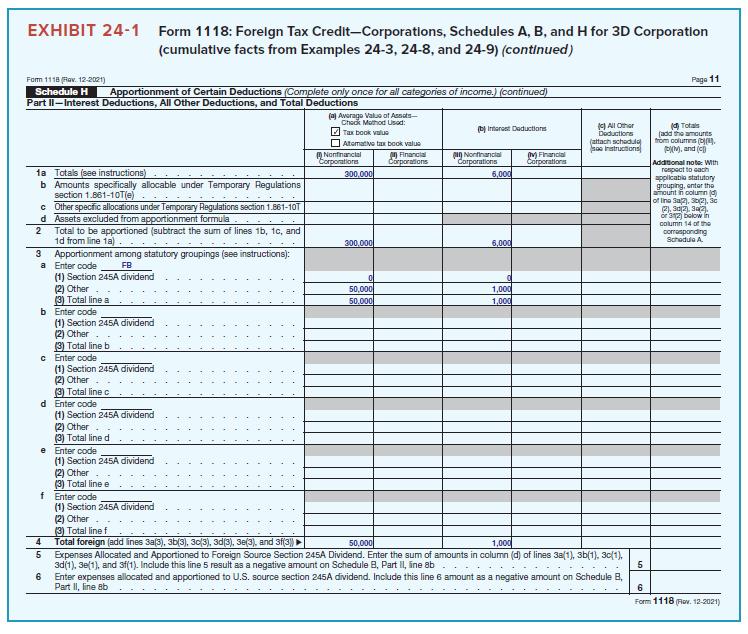

EXHIBIT 24-1 Form 1118 (Rav. December 2021) Department of the Treasury Internal Revenue Service Nama of corporation 3D Corporation Use a separate Form 1118 for each applicable category of Income (see instructions). a Separate Category (Enter code-see instructions.). A B C Trob A B C Totals (add lines A through C) A b If code 901] is entered on line a, enter the country code for the sanctioned country (see Instructions) c If one of the RBT codes is entered on line a, enter the country code for the treaty country (see Instructions) Schedule A B C T APOTE Form 1118: Foreign Tax Credit-Corporations, Schedules A, B, and H for 3D Corporation (cumulative facts from Examples 24-3, 24-8, and 24-9) For calendar year 20 1. EIN or Reference ID Number (see Instructions" 6. Gross Rants, Royaltis, and License Foos Income or (Loss) Before Adjustments (Report all amounts in U.S. dollars. See Specific Instructions.) 2. Foreign country or U.S. Possession Jantar two-latter code- usa a separate line for ach) (no Instructions CN Dividends Received Deduction (see Instructions) (h) Curancy Loss Foreign Tax Credit-Corporations ► Attach to the corporation's tax return. ►Go to www.irs.gov/Form1118 for instructions and the latest information. or other tax yaar beginning 20 and onding 7. Salos 40,000 (b) Deduction Allowad Under Section 250(a)(1)(A)-Foraign Derived Intangible Income Currency Loss Code [Instruction) 40,000 8. Gross Income From Performance of Services (c) Deduction Allowed Under Section 250(18)-Global Intangible Low-Taxed Income 13. Alocable Deductions (continued) Other Allocable Deductions (attach schedule (Instructions) 3. Inclusions Under Sections 961(41) and 961A instructions) (P) Gross-up (action jaj Exclude Gross-Up 9. Currency Gain 13. Allocablo Deductions Gross Income or (Loss) From Sources Outside the United States (Total Allocable Deductions (add columns 13) through 15 and 13 (d) Depreciation, Deplation, and Amortization Rantal, Royalty, and Licensing Expansios 10,000 10. Currency Gain Code (see instructions) (0) Other Allocable Expenses 14. Apportioned Shara of Deductions jantar amount from applicable line of Schedule H, Part 1, column (b), and Schedule H, Part column (d 1,000 15. Not Operating Loss Daduction Employer identification number Cat No. 10000F 4. Dividend (soo instructions) 11. Other atach schedule) Expams Allocable to Sales Income 10,000 10,000 OMB No. 1546-0123 Attachment Sequence No. 118 16. Total Deductions [add columns 130 through 16) 11,000 FB 5. Interest 12. Total (add columns (a) through 9 and 11) 40,000 40,000 (g) Expansus Allocatio to Gross Income From Performance of Services 17. Tutal income or Loss Batore Adjustments (subtract column 16 from column 12) 29,000 10,000 1,000 11,000 29,000 *For section 863(b) income, NOLS, income from RICs, high-taxed income, section 951A, and roattribution of income by reason of disregarded payments, use a single line (see instructions). Also, for reporting branches that are QBUs, use a separate line for each such branch. For Paperwork Reduction Act Notice, see separate instructions. Form 1118 (Rav. 12-2021)

Step by Step Answer:

Form 1118 Part I 1a Enter the name of the country in which the income was earned Germany 1b Enter th...View the full answer

Taxation Of Individuals And Business Entities 2023 Edition

ISBN: 9781265790295

14th Edition

Authors: Brian Spilker, Benjamin Ayers, John Barrick, Troy Lewis, John Robinson, Connie Weaver, Ronald Worsham

Students also viewed these Business questions

-

Euro Corporation, a U.S. corporation, operates through a branch in Germany. During 2015 the branch reported taxable income of $1,000,000 and paid German income taxes of $300,000. In addition, Euro...

-

Euro Corporation, a U.S. corporation, operates through a branch in Germany. During 2020 the branch reported taxable income of $1,000,000 and paid German income taxes of $300,000. In addition, Euro...

-

Euro Corporation, a U.S. corporation, operates through a branch in Germany. During 2014 the branch reported taxable income of $1,000,000 and paid German income taxes of $300,000. In addition,...

-

Methanol, CH3OH, is prepared industrially from the gasphase catalytic balanced reaction that has been depicted here using molecular models. In a laboratory test, a reaction vessel was filled with...

-

Given the joint density Show that the random variables X and Y are uncorrelated but not independent. for-y

-

In Problem use the pricedemand equation 2p + 0.0lx = 50, 0 p 25. Express the demand x as a function of the price p.

-

3. On December 31, 2014, Jenna OYJ purchased a building from Mikko OYJ for $2,000,000. At that date, the building had a book value of $1,500,000 and a remaining useful life of 20 years. Jenna OYJ...

-

Selected information follows for Mount Olympus Corporation for three independent situations: 1. Mount Olympus purchased a patent from Bakhshi Co. for $1.8 million on January 1, 2012. The patent...

-

Denton Company manufactures and sells a single product. Cost data for the product are given: Variable costs per unit: Direct materials $ 6 Direct labor 10 Variable manufacturing overhead 2 Variable...

-

Scott Kelly is reviewing MasterToy's financial statements in order to estimate its sustainable growth rate. Consider the information presented in the following exhibit. a. Identify and calculate the...

-

Carmen SanDiego, a U.S. citizen, is employed by General Motors Corporation, a U.S. corporation. On April 1, 2022, GM relocated Carmen to its Brazilian operations for the remainder of 2022. Carmen was...

-

China became a net exporter of cars for the first time in 2005, due in part to the large-scale inward investment from non-Chinese car manufacturers, channelled into joint ventures with local firms in...

-

Give the products that would be obtained from the reaction of the following compounds with Cl2: a. b. c. d. OCH CH3 NO2

-

Think back to a time you experienced a communication breakdown in a personal or social setting (something you're comfortable discussing with the class in a public forum). 1. Did you figure out why...

-

Imagine you are visiting your aunt, who is a patient in a hospital in a nearby city. While you are sitting at her bedside, you hear a lot of noise at the nurses' station, as if they are having a...

-

Using Houseplan #5 on page 4 of the Measurement supplement(below), determine the cost of pouring the 9 inch thick concreteslab for this home, assuming that the porch will also be on thefoundation....

-

Recall from lecture that Flip-Flap Railway is an old roller coaster that was built in a circle. It has a diameter of 25 ft and riders entered the ride at a speed of 45 mph. At the top of the loop,...

-

Small Fry Design, founded in 1997, is a toy and accessories company that designs and imports products for children. The company's line of merchandise includes teddy bears, musical toys, rattles and...

-

Fill in the blanks with an appropriate word, phrase, or symbol(s). In any modulo m system, we can develop a set of modulo classes by dividing the numbers by m and placing all numbers with the same...

-

Activator rod AB exerts on crank BCD a force P directed along line AB. Knowing that P must have a 100-N component perpendicular to arm BC of the crank, determine (a) The magnitude of the force P, (b)...

-

On January 1 of 2018, Jason and Jill Marsh acquired a home for $500,000 by paying $400,000 down and borrowing $100,000 with a 7 percent loan secured by the home.On January 1, 2019, the Marshes needed...

-

Rajiv and Laurie Amin are recent college graduates looking to purchase a new home.They are purchasing a $200,000 home by paying $20,000 down and borrowing the other $180,000 with a 30-year loan...

-

Jesse Brimhall is single.In 2018, his itemized deductions were $9,000 before considering any real property taxes he paid during the year. Jesses adjusted gross income was $70,000 (also before...

-

What is the NPV of a project that costs $34,000 today and is expected to generate annual cash inflows of $11,000 for the next 7 years, followed by a final inflow of $14,000 in year 8. Cost of capital...

-

help!!! Use the above information to calculate ending inventory using FIFO for a company that uses a perpetua/inventory system

-

Rocky Mountain Chocolate Factory (RMCF) founder and president Frank Crail employs 220 people in 361 outlets in the United States, Canada, United Arab Emirates, Japan, South Korea and Saudi Arabia. If...

Study smarter with the SolutionInn App