In 2022, Nadia has $100,000 of regular taxable income. She itemizes her deductions as follows: real property

Question:

In 2022, Nadia has $100,000 of regular taxable income. She itemizes her deductions as follows: real property taxes of $1,500, state income taxes of $2,000, and mortgage interest expense of $10,000 (acquisition indebtedness of $200,000). In addition, she receives tax-exempt interest of $1,000 from a municipal bond (issued in 2006) that was used to fund a new business building for a (formerly) out-of-state employer. Finally, she received a state tax refund of $300 from the prior year.

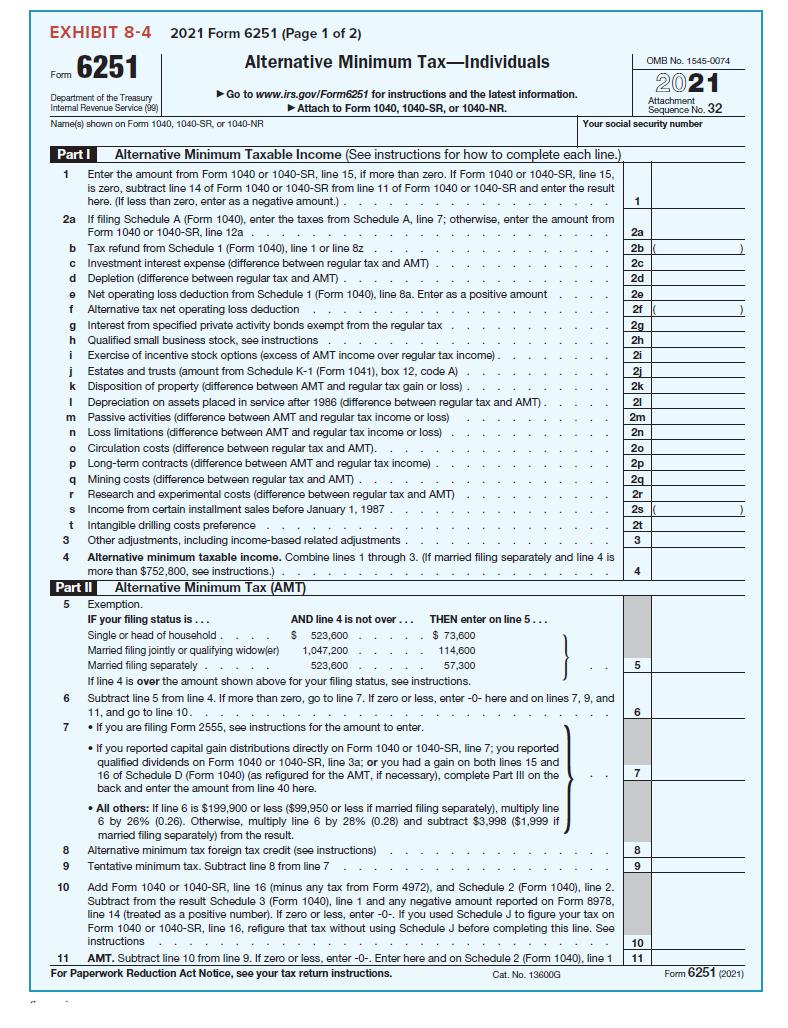

a) What is Nadia’s AMTI this year if she deducted $15,000 of itemized deductions last year (including a total of $4,000 of real property taxes and state income taxes) and did not owe any AMT last year? Complete Form 6251 (through line 4) for Nadia.

b) What is Nadia’s AMTI this year if she deducted the standard deduction last year and did not owe any AMT last year? Complete Form 6251 (through line 4) for Nadia.

From 6251

EXHIBIT 8-4 2021 Form 6251 (Page 1 of 2) Form 6251 Department of the Treasury Internal Revenue Service (99) Name(s) shown on Form 1040, 1040-SR, or 1040-NR b c d Part I Alternative Minimum Taxable Income (See instructions for how to complete each line.) Enter the amount from Form 1040 or 1040-SR, line 15, if more than zero. If Form 1040 or 1040-SR, line 15, is zero, subtract line 14 of Form 1040 or 1040-SR from line 11 of Form 1040 or 1040-SR and enter the result here. (If less than zero, enter as a negative amount.). ... 1 2a If filing Schedule A (Form 1040), enter the taxes from Schedule A, line 7; otherwise, enter the amount from Form 1040 or 1040-SR, line 12a. j k Alternative Minimum Tax-Individuals 1 I ►Go to www.irs.gov/Form6251 for instructions and the latest information. ► Attach to Form 1040, 1040-SR, or 1040-NR. e Net t operating loss deduction from Schedule 1 (Form 1040), line 8a. Enter as a positive amount Alternative tax net operating loss deduction f duction g Interest from specified private activity bonds exempt from the regular tax h Qualified small business stock, see instructions i Exercise of incentive stock options (excess of AMT income over regular tax income) Fa Estates and trusts (amount from Schedule K-1 (Form 1041), box 12, code A) Disposition of property (difference between AMT and regular tax gain or loss) Depreciation on assets placed in service after 1986 (difference between regular tax and AMT). m Passive activities (difference between AMT and regular tax income or loss) n Loss limitations (difference between AMT and regular tax income or loss) o Circulation costs (difference between regular tax and AMT). p Long-term contracts (difference between AMT and regular tax income) q Mining costs (difference between regular tax and AMT) r Research and experimental costs (difference between regular tax and AMT) s Income from certain installment sales before January 1, 1987. t Intangible drilling costs preference..... 3 Other adjustments, including income-based related adjustments Tax refund from Schedule 1 (Form 1040), line 1 or line 8z Investment interest expense (difference between regular tax and AMT) Depletion (difference between regular tax and AMT) 8 9 10 - ... 4 Alternative minimum taxable income. Combine lines 1 through 3. (If married filing separately and line 4 is more than $752,800, see instructions.) Part II Alternative Minimum Tax (AMT) 5 Exemption. IF your filing status is ... Single or head of household. ... Married filing jointly or qualifying widow(er) Married filing separately..... If line 4 is over the amount shown above for your filing status, see instructions. AND line 4 is not over... $ 523,600 1,047,200 523,600 THEN enter on line 5... $ 73,600 114,600 57,300 6 Subtract line 5 from line 4. If more than zero, go to line 7. If zero or less, enter -0- here and on lines 7, 9, and 11, and go to line 10... 7. If you are filing Form 2555, see instructions for the amount to enter. sen Your social security number • If you reported capital gain distributions directly on Form 1040 or 1040-SR, line 7; you reported qualified dividends on Form 1040 or 1040-SR, line 3a; or you had a gain on both lines 15 and 16 of Schedule D (Form 1040) (as refigured for the AMT, if necessary), complete Part III on the back and enter the amount from line 40 here. • All others: If line 6 is $199,900 or less ($99,950 or less if married filing separately), multiply line 6 by 26% (0.26). Otherwise, multiply line 6 by 28% (0.28) and subtract $3,998 ($1,999 if married filing separately) from the result. Alternative minimum tax foreign tax credit (see instructions) Tentative minimum tax. Subtract line 8 from line 7 Add Form 1040 or 1040-SR, line 16 (minus any tax from Form 4972), and Schedule 2 (Form 1040), line 2. Subtract from the result Schedule 3 (Form 1040), line 1 and any negative amount reported on Form 8978, line 14 (treated as a positive number). If zero or less, enter -0-. If you used Schedule J to figure your tax on Form 1040 or 1040-SR, line 16, refigure that tax without using Schedule J before completing this line. See instructions..... ...... ... 11 AMT. Subtract line 10 from line 9. If zero or less, enter -0-. Enter here and on Schedule 2 (Form 1040), line 1 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 13600G 1 2a 2b 2c 2d 2e 2f 2g 2h 21 2j 2k 21 2m 2n 20 2p 2q 2r 2s 2t 3 4 5 6 7 OMB No. 1545-0074 2021 Attachment Sequence No. 32 8 9 10 11 Form 6251 (2021)

Step by Step Answer:

Nadias AMTI is 104200 Description Amount Explanation 1 Regular taxable income ...View the full answer

Taxation Of Individuals And Business Entities 2023 Edition

ISBN: 9781265790295

14th Edition

Authors: Brian Spilker, Benjamin Ayers, John Barrick, Troy Lewis, John Robinson, Connie Weaver, Ronald Worsham

Students also viewed these Business questions

-

Maple Corporation reports $500,000 of regular taxable income for the current year. Maple also reports the following amounts of interest income earned during the current year (reflected in regular...

-

Subach Corporation reports $600,000 of regular taxable income for the current year. Subach also reports the following information (reflected in regular taxable income, if applicable): Subach is not a...

-

Beggin Corporation had $100,000 of regular taxable income in 2017. It had $40,000 of positive adjustments and a $50,000 preference item. What was the corporations alternative minimum tax liability...

-

With reference to the Auditors Report, answer the following questions: The recent final audit report of an FMCG carries a line which is read as in the manner so required and respectively give a true...

-

List the advantages and disadvantages of horizontal, learning, virtual, liberation management, and egalitarian organization structures.

-

Which of the following should be capitalized when a piece of production equipment is acquired for a factory? a. Sales tax b. Transportation costs c. Installation costs d. All of the above

-

Determine employer liabilities for pay roll, including liabilities arising from employee earnings and deductions from earnings. AppendixLO1

-

A project manager has compiled a list of major activities that will be required to install a computer information system in her firm. The list includes estimated completion times for activities and...

-

Multiple Select Question Select all that apply Which of the 2 profitability ratios come right from the common size income statement? (Select the 2 that apply.) Fixed asset ratio Gross profit...

-

You are evaluating the results of a nonstatistical sample of 85 accounts receivable confirmations for the Bohrer Company. Information on the sample and population are included below. An overstatement...

-

John bought 1,000 shares of Intel stock on October 18, 2018, for $30 per share plus a $750 commission he paid to his broker. On December 12, 2022, he sells the shares for $42.50 per share. He also...

-

Jackson is 18 years old and has a dog-sitting business. Calculate the 2022 standard deduction Jackson will claim under the following independent circumstances. a) Jackson reported $2,000 of earnings...

-

Find each limit, if it exists. (a) (b) (c) lim 5- 2/2 3x - 4

-

Write a function that takes as input a non-negative integer in the range 0 to 99 and returns the English word(s) for the number as a string. Multiple words should be separated by a space. If the...

-

The Event Manager sighed as the festival approached and she had only five crafts vendors who had committed to taking part in the marketplace. She and her assistant were frantic. They had been...

-

the systematic recording, analysis, and interpretation of costs incurred by a business. Its significance extends beyond mere financial tracking; it plays a pivotal role in aiding management...

-

1.What is your process for ensuring that all your work is correct? 2.What do you mean by Batch Costing ? 3.Explain the accounting procedure for Batch Costing 4.State the applicability of Job Costing...

-

The increasing occurrence of freak weather incidents will have both local and global effects. Even in cases where production has been re-localized, freak weather can still greatly impact local...

-

Change the number to a percent. Round your answer to the nearest tenth of a percent. 0.041

-

Consider the activities undertaken by a medical clinic in your area. Required 1. Do you consider a job order cost accounting system appropriate for the clinic? 2. Identify as many factors as possible...

-

Assume Ritas consulting business generated $13,000 in gross income for the current year. Further, assume Rita uses the actual expense method for computing her home office expense deduction. a. What...

-

James and Kate Sawyer were married on New Years Eve of 2019. Before their marriage, Kate lived in New York and worked as a hair stylist for one of the citys top salons. James lives in Atlanta where...

-

Did the tax lax law changes effective in 2018 increase or decrease the amount of the double tax on C corporation income? Explain.

-

Question 24 Not yet answered Marked out of 1.00 P Flag question Muscat LLC's current assets and current liabilities are OMR 258,000 and OMR 192,000, respectively. In the year 2020, the company earned...

-

Question 24 Miami Company sold merchandise for which it received $710,400, including sales and excise taxes. All of the firms sales are subject to a 6% sales tax but only 50% of sales are subject to...

-

f the IRS intends to close a Taxpayer Assistance Center, they must notify the public at least _____ days in advance of the closure date. 14 30 60 90

Study smarter with the SolutionInn App