In 2022, Sven is single and has $120,000 of regular taxable income. He itemizes his deductions as

Question:

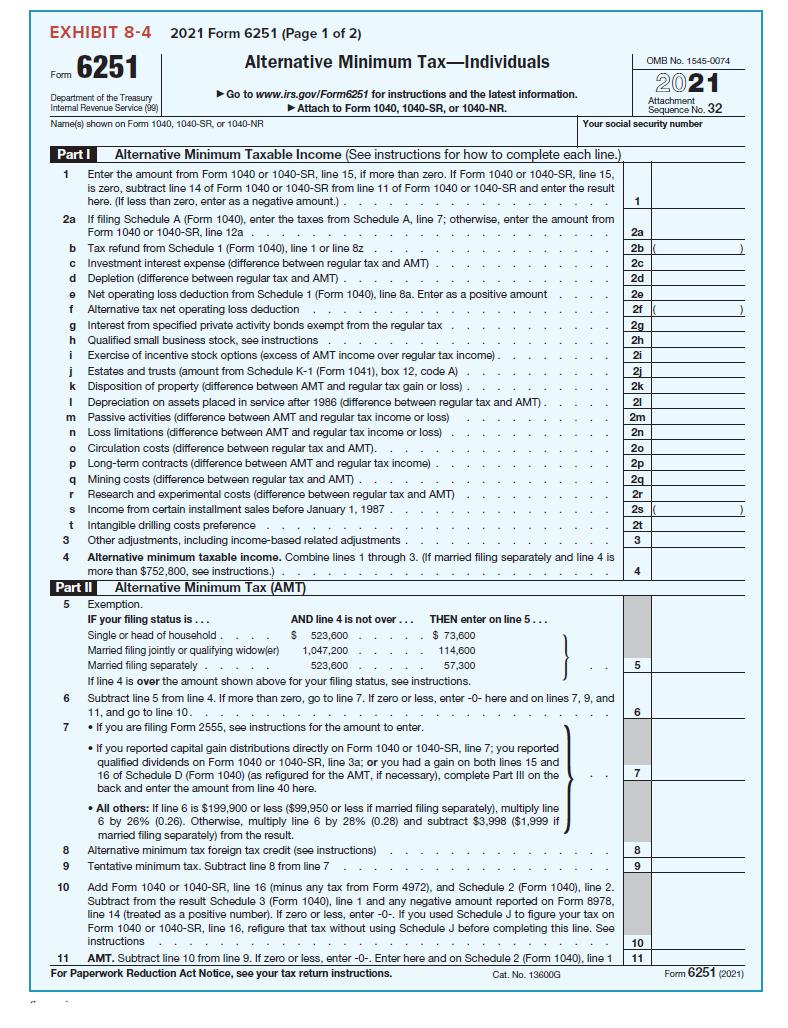

In 2022, Sven is single and has $120,000 of regular taxable income. He itemizes his deductions as follows: real property tax of $2,000, state income tax of $4,000, and mortgage interest expense of $15,000 (acquisition debt of $300,000). He also has a positive AMT depreciation adjustment of $500. What is Sven’s alternative minimum taxable income (AMTI)? Complete Form 6251 (through line 4) for Sven.

From 6251

Transcribed Image Text:

EXHIBIT 8-4 2021 Form 6251 (Page 1 of 2) Form 6251 Department of the Treasury Internal Revenue Service (99) Name(s) shown on Form 1040, 1040-SR, or 1040-NR b c d Part I Alternative Minimum Taxable Income (See instructions for how to complete each line.) Enter the amount from Form 1040 or 1040-SR, line 15, if more than zero. If Form 1040 or 1040-SR, line 15, is zero, subtract line 14 of Form 1040 or 1040-SR from line 11 of Form 1040 or 1040-SR and enter the result here. (If less than zero, enter as a negative amount.). ... 1 2a If filing Schedule A (Form 1040), enter the taxes from Schedule A, line 7; otherwise, enter the amount from Form 1040 or 1040-SR, line 12a. j k Alternative Minimum Tax-Individuals 1 I ►Go to www.irs.gov/Form6251 for instructions and the latest information. ► Attach to Form 1040, 1040-SR, or 1040-NR. e Net t operating loss deduction from Schedule 1 (Form 1040), line 8a. Enter as a positive amount Alternative tax net operating loss deduction f duction g Interest from specified private activity bonds exempt from the regular tax h Qualified small business stock, see instructions i Exercise of incentive stock options (excess of AMT income over regular tax income) Fa Estates and trusts (amount from Schedule K-1 (Form 1041), box 12, code A) Disposition of property (difference between AMT and regular tax gain or loss) Depreciation on assets placed in service after 1986 (difference between regular tax and AMT). m Passive activities (difference between AMT and regular tax income or loss) n Loss limitations (difference between AMT and regular tax income or loss) o Circulation costs (difference between regular tax and AMT). p Long-term contracts (difference between AMT and regular tax income) q Mining costs (difference between regular tax and AMT) r Research and experimental costs (difference between regular tax and AMT) s Income from certain installment sales before January 1, 1987. t Intangible drilling costs preference..... 3 Other adjustments, including income-based related adjustments Tax refund from Schedule 1 (Form 1040), line 1 or line 8z Investment interest expense (difference between regular tax and AMT) Depletion (difference between regular tax and AMT) 8 9 10 - ... 4 Alternative minimum taxable income. Combine lines 1 through 3. (If married filing separately and line 4 is more than $752,800, see instructions.) Part II Alternative Minimum Tax (AMT) 5 Exemption. IF your filing status is ... Single or head of household. ... Married filing jointly or qualifying widow(er) Married filing separately..... If line 4 is over the amount shown above for your filing status, see instructions. AND line 4 is not over... $ 523,600 1,047,200 523,600 THEN enter on line 5... $ 73,600 114,600 57,300 6 Subtract line 5 from line 4. If more than zero, go to line 7. If zero or less, enter -0- here and on lines 7, 9, and 11, and go to line 10... 7. If you are filing Form 2555, see instructions for the amount to enter. sen Your social security number • If you reported capital gain distributions directly on Form 1040 or 1040-SR, line 7; you reported qualified dividends on Form 1040 or 1040-SR, line 3a; or you had a gain on both lines 15 and 16 of Schedule D (Form 1040) (as refigured for the AMT, if necessary), complete Part III on the back and enter the amount from line 40 here. • All others: If line 6 is $199,900 or less ($99,950 or less if married filing separately), multiply line 6 by 26% (0.26). Otherwise, multiply line 6 by 28% (0.28) and subtract $3,998 ($1,999 if married filing separately) from the result. Alternative minimum tax foreign tax credit (see instructions) Tentative minimum tax. Subtract line 8 from line 7 Add Form 1040 or 1040-SR, line 16 (minus any tax from Form 4972), and Schedule 2 (Form 1040), line 2. Subtract from the result Schedule 3 (Form 1040), line 1 and any negative amount reported on Form 8978, line 14 (treated as a positive number). If zero or less, enter -0-. If you used Schedule J to figure your tax on Form 1040 or 1040-SR, line 16, refigure that tax without using Schedule J before completing this line. See instructions..... ...... ... 11 AMT. Subtract line 10 from line 9. If zero or less, enter -0-. Enter here and on Schedule 2 (Form 1040), line 1 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 13600G 1 2a 2b 2c 2d 2e 2f 2g 2h 21 2j 2k 21 2m 2n 20 2p 2q 2r 2s 2t 3 4 5 6 7 OMB No. 1545-0074 2021 Attachment Sequence No. 32 8 9 10 11 Form 6251 (2021)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (8 reviews)

Svens AMTI is 126500 Description Amount Explanation 1 Regular taxable incom...View the full answer

Answered By

Branice Buyengo Ajevi

I have been teaching for the last 5 years which has strengthened my interaction with students of different level.

4.30+

1+ Reviews

10+ Question Solved

Related Book For

Taxation Of Individuals And Business Entities 2023 Edition

ISBN: 9781265790295

14th Edition

Authors: Brian Spilker, Benjamin Ayers, John Barrick, Troy Lewis, John Robinson, Connie Weaver, Ronald Worsham

Question Posted:

Students also viewed these Business questions

-

In 2014, Sven is single and has $120,000 of regular taxable income. He itemizes his deductions as follows: real property tax of $2,000, state income tax of $4,000, mortgage interest expense of...

-

In 2017, Sven is single and has $120,000 of regular taxable income. He itemizes his deductions as follows: real property tax of $2,000, state income tax of $4,000, mortgage interest expense of...

-

In 2015, Sven is single and has $120,000 of regular taxable income. He itemizes his deductions as follows: real property tax of $2,000, state income tax of $4,000, mortgage interest expense of...

-

A Hydrogen atom has one proton in the nucleus and one electron in the shell. In a classic model of the atom, in a certain state, this electron is in a circular orbit around the nucleus with an...

-

1. Attempt to draw the new Finance Department and the Hickory Handles organization chart as Mr. Whiteshirt has described it. 2. What problems exist with Mr. Whiteshirts concept?

-

As of February 29, 2016, American Greetings Corp. had 7,000 full-time and 20,500 part-time employees. Assume in the last pay period of the year, the company paid $8,000,000 to employees after...

-

A business issued a $5,000, 60-day note to a sup plier, which discounted the note at 12%. The pro ceeds are: A. $4,400 C. $5,000 B. $4,900 D. $5,100 AppendixLO1

-

Benson Oil is being considered for acquisition by Dodd Oil. The combination, Dodd believes, would increase its cash inflows by $25,000 for each of the next 5 years and by $50,000 for each of the...

-

Pronghorn's Medical operates three support departments and two operating units, Surgery and ER . The support departments are allocated based on the hours used. The cost of operating the accounting (...

-

Lawson Furniture purchased land, paying $65,000 cash and signing a $250,000 note payable. In addition, Lawson paid delinquent property tax of $5,000, title insurance costing $4,000, and $9,000 to...

-

Jennies grandmother paid her tuition this fall to State University (an eligible educational institution). Jennie is claimed as a dependent by her parents, but she also files her own tax return. Can...

-

In 2022, for a taxpayer with $50,000 of taxable income, without doing any actual computations, which filing status do you expect to provide the lowest tax liability? Which filing status provides the...

-

A company calculated the predetermined overhead based on an estimated overhead of $70,000, and the activity for the cost driver was estimated as 2,500 hours. If product A utilized 1,350 hours and...

-

there are some solbeed with direct materials. this one says direct labor. any help would be appreciated, ive been stuck Chapter 9 Homework Save 1.5 6 H 305 Parker Plastic, Incorporated, manufactures...

-

Give examples of applications where pumps might be connected in series. Give examples of applications where pumps might be connected in parallel. Drawing on the conclusions of earlier exercises,...

-

a truck company has 2 trucks, which are hired out day by day. The average number of trucks hired on a day follows a distribution with mean 1 . 5 . Identify the distribution and then find the...

-

Designand drive selectionfor a hydrostaticapplication.Choose anypropelledequipmentwithopen or closedloop HST. Includethepayloadand/or anymachinefunctionrequirementsfor the mobileequipment.A sketch...

-

A two stage air compressor with ideal intercooler pressure and perfect intercooling (what does this mean?) compresses air from 1 bar to 16 bar at the rate of 5 m3/min. Mechanical efficiency of the...

-

Fill in the blanks with an appropriate word, phrase, or symbol(s). The total amount of money the borrower must pay for borrowing the money is called the ________ charge.

-

In exchange for land, the company received a 12-month note on January 1. The face amount of the note is $1,000, and the stated rate of interest is 13%, compounded annually. The 13% rate is equal to...

-

Elvira is a self-employed taxpayer who turns 42 years old at the end of the year (2020). In 2020, her net Schedule C income was $130,000. This was her only source of income. This year, Elvira is...

-

Hope is a self-employed taxpayer who turns 54 years old at the end of the year (2020). In 2020, her net Schedule C income was $130,000. This was her only source of income. This year, Hope is...

-

Rita is a self-employed taxpayer who turns 39 years old at the end of the year (2020). In 2020, her net Schedule C income was $300,000. This was her only source of income. This year, Rita is...

-

Duncan Inc. issued 500, $1,200, 8%, 25 year bonds on January 1, 2020, at 102. Interest is payable on January 1. Duncan uses straight-line amortization for bond discounts or premiums. INSTRUCTIONS:...

-

WISE-HOLLAND CORPORATION On June 15, 2013, Marianne Wise and Dory Holland came to your office for an initial meeting. The primary purpose of the meeting was to discuss Wise-Holland Corporation's tax...

-

Stock in ABC has a beta of 0.9. The market risk premium is 8%, and T-bills are currently yielding 5%. The company's most recent dividend is $1.60 per share, and dividends are expected to grow at a 6%...

Study smarter with the SolutionInn App