(a) Byron began trading on 1 November 2016, preparing accounts to 31 October each year. He decided...

Question:

(a) Byron began trading on 1 November 2016, preparing accounts to 31 October each year. He decided to change his accounting date to 31 August and the first accounts made up to the new date were for the period from 1 November 2018 to 31 August 2019.

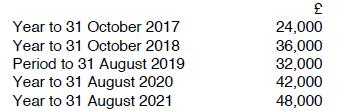

The conditions necessary for a change of basis period were all satisfied. The adjusted trading profits for Byron's first five periods of account were as follows:

Compute Byron's trading income for years 2016-17 to 2021-22.

(b) Michelle began trading on 1 January 2017, preparing accounts to 31 December each year. She decided to change her accounting date to 28/29 February and the first accounts made up to the new date were for the period from 1 January 2020 to 28 February 2021. The conditions necessary for a change of basis period were all satisfied. The adjusted trading profits for Michelle's first five periods of account were:

Compute Michelle's trading income for years 2016-17 to 2021-22.

Step by Step Answer: