A company acquired a chargeable asset (not a chattel) in 1979. The asset was sold in December

Question:

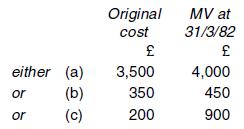

A company acquired a chargeable asset (not a chattel) in 1979. The asset was sold in December 2017 (RPI 274.7) for £2,800. Compute the chargeable gain or allowable loss if the original cost of the asset and its market value on 31 March 1982 (RPI 79.44) were:

Transcribed Image Text:

either (a) or (b) or (c) Original cost 3,500 350 200 MV at 31/3/82 4,000 450 900

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

a b Sale proceeds Less Original cost Market value 31382 Allowable loss Sale proceeds Less Original c...View the full answer

Answered By

Ashish Jaiswal

I have completed B.Sc in mathematics and Master in Computer Science.

4.90+

20+ Reviews

39+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

For the normal distribution described in Exercise 7.12, what tax preparation fee would have been exceeded by 90% of the tax preparation customers? In exercise Assuming a normal distribution and a...

-

PCC Ltd is a manufacturing company which prepares accounts to 31 December each year. The company made the following disposals of chargeable assets in the year to 31 December 2017: (i) On 12 September...

-

Timberlake Ltd prepares accounts to 31 March each year. The company made the following disposals of chargeable assets in the year to 31 March 2018: (i) In February 2018 , a rare Bentley motor car...

-

Review each of the following independent sets of conditions. Required: Use AICPA sample size tables to identify the appropriate sample size for use in a statistical sampling application (ROO 5 risk...

-

Assuming that the rate-determining step in the reaction of cyclohexanol with hydrogen bromide to give cyclohexyl bromide is unimolecular, write an equation for this step. Use curved arrows to show...

-

LO10 What is the purpose of the related party rules as they apply to sales of property?

-

a doctorate.

-

Milton Industries expects free cash flows of $5 million each year. Miltons corporate tax rate is 35%, and its unlevered cost of capital is 15%. The firm also has outstanding debt of $19.05 million,...

-

U 6 2 0 0 . 0 0 1 - Accounting for International & Public Affairs - Final Exam - Fall 2 0 2 3 ( 2 ) For book purposes, for this transaction, would the company recognize more, less or the same income...

-

During the year to 31 March 2018 , a company which qualifies as medium-sized spends 180,000 on research and development . This is qualifying expenditure under the R&D tax relief scheme. Explain the...

-

A company prepares accounts to 31 December each year and lets two properties to tenants. The following information relates to the year to 31 December 2017: (a) Property A is owned by the company. The...

-

Why is excess cash a non-operating asset (NOA)? Why does it make sense to add the value of excess cash to the value of the discounted cash flows when we use the W ACC or FCFE approach to value a...

-

CASE 7.2 Oracle Corporation: Share-Based Compensation Effects/Statement of Shareholders' Equity A sales-based ranking of software companies provided by Yahoo! Finance on November 5, Year 8, places...

-

A manufacturer of ovens sells them for $1,450 each. The variable costs are $800 per unit. The manufacturer's factory has annual fixed costs of $1,735,000. a. Given the expected sales volume of 3,100...

-

1.1 Explain the vitality of a strategy on businesses like Dell. (15) 1.2 Critically discuss the underlying objectives Dell should follow when formulating its business strategy. (20) 1.3 Discuss the...

-

Our international business plan involves exporting a sustainable apparel brand from India to UK. We will be exploring this plan in further detail below: Product/ Service: Sustainable clothing line...

-

If X is a random variable with probability density function f given by: f (x) = 4x 4x 3 when 0 x 1 and 0 otherwise, compute the following quantities: (a) The cumulative distribution function F...

-

Thisn'that Enterprises Ltd reports the following information: From this information, calculate and interpret the following ratios (year-end figures will have to be used because the comparative year...

-

You purchase a bond with a coupon rate of 6.7 percent, a par value $1,000, and a clean price of $905. Assume a par value of $1,000. If the next semiannual coupon payment is due in two months, what is...

-

Suzanne acquired the following ordinary shares in Quarine plc: She made no further acquisitions and the shares were valued at 3.20 each on 31 March 1982. On 24 July 2021, Suzanne sold 1,200 shares...

-

In June 2020, Walter bought 10,000 shares in Ovod plc at a cost of 7 per share. In September 2021, Rundico plc made a takeover bid for Ovod plc, offering the Ovod shareholders eight Rundico shares...

-

(a) In November 2009, Yorick bought 6,000 ordinary shares in Togon plc for 30,000. In March 2022, the company went into liquidation and Yorick received a first distribution of 1 per share. The market...

-

The star Mira is 1.2 times the mass of the Sun and about 10,000 times more luminous than the Sun. Would Mira fit into the table above? Why or why not?

-

Which of the following was one of the most valuable benefits a company received as a sponsor of NHL games?

-

Cinder Inc. is a Canadian-controlled private corporation based in your province. The company operates a wholesale business. The following information is provided for its year ended May 31, 2023: Net...

Study smarter with the SolutionInn App