A company made the following disposals during the year to 31 March 2018: (a) A factory building

Question:

A company made the following disposals during the year to 31 March 2018:

(a) A factory building was sold for £650,000 on 13 June 2017 (RPI 271.1). This building had cost £300,000 in August 2000 (RPI 170.5) and was extended in July 2002 (RPI 175.9) at a cost of £50,000.

(b) An office building was sold for £1,100,000 on 15 September 2017 (RPI 272.9) and was immediately replaced by another office building costing £ 1,050,000. The building sold in September 2017 had cost £600,000 in February 2002 (RPI 173.8).

Rollover relief was claimed on the disposal of this building.

(c) A computer system was given to a charity on 14 July 2017 (RPI 271.7). This computer system had cost £5,000 in September 2012 (RPI 244.2) and had a market value of £500 in July 2017.

Capital allowances had been claimed in relation to the computer system.

(d) A motor car was sold for £80,000 on 12 June 2017 (RPI 271.1). The car h ad cost

£100,000 in June 2014 (RPI256.

3). Capital allowances had been claimed.

(e) An item of movable plant and machinery was sold for £30,000 on 16 September 2017 (RPI 272.9). Th is item had cost £70,000 in January 2011 (RPI 229.0) and capital allowances had been claimed in relation to the item.

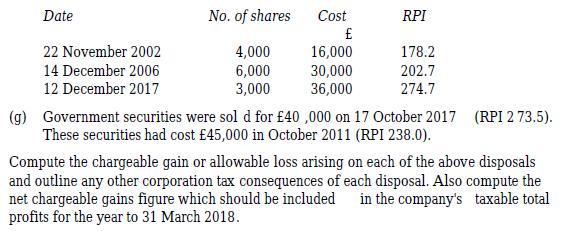

(f) 8,000 ordinary shares in Exxak plc were sold for £80,000 on 18 Dec ember 2017

(RPI274.7). Shares in Exxak plc had been bought as follows:

Step by Step Answer: