After deducting capital allowances for the year to 31 December 2016, the tax written down values of

Question:

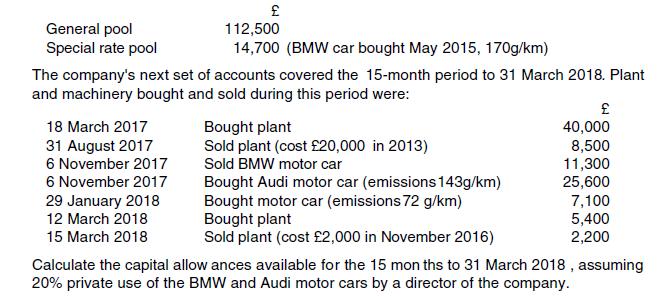

After deducting capital allowances for the year to 31 December 2016, the tax written down values of a company's plant and machinery were as follows:

Transcribed Image Text:

General pool Special rate pool 112,500 14,700 (BMW car bought May 2015, 170g/km) The company's next set of accounts covered the 15-month period to 31 March 2018. Plant and machinery bought and sold during this period were: 18 March 2017 31 August 2017 6 November 2017 6 November 2017 29 January 2018 12 March 2018 15 March 2018 Bought plant Sold plant (cost 20,000 in 2013) Sold BMW motor car Bought Audi motor car (emissions 143g/km) Bought motor car (emissions 72 g/km) Bought plant Sold plant (cost 2,000 in November 2016) 40,000 8,500 11,300 25,600 7,100 5,400 2,200 Calculate the capital allow ances available for the 15 months to 31 March 2018, assuming 20% private use of the BMW and Audi motor cars by a director of the company.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

The 15month period of account must be broken down ...View the full answer

Answered By

Fahmin Arakkal

Tutoring and Contributing expert question and answers to teachers and students.

Primarily oversees the Heat and Mass Transfer contents presented on websites and blogs.

Responsible for Creating, Editing, Updating all contents related Chemical Engineering in

latex language

4.40+

8+ Reviews

22+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Ian owns a lar ge manufacturing business and prepares accounts to 31 December each year. The written down value of his main pool of plant and machinery after deducting capital allowances for the year...

-

Talat owns a large retail business and prepares accounts to 31 December each year. The written down value of his plant and machinery after deducting capital allowances for the year to 31 December...

-

Patrick prepares accounts to 31 August each year. The written down value of his main pool of plant and machinery after deducting capital allowance s for the year to 31 August 2016 was 1,900. There...

-

What risks accompany a standby credit letter for (a) the issuer and (b) the beneficiary?

-

The pKas of methanol (CH3OH) and methanethiol (CH3SH) are 16 and 11, respectively. Which is more basic, KOCH3 or KSCH3?

-

LO5 What is the purpose of the passive loss rules?

-

Can any of the events in Exercises 5558 be considered unusual? Explain.

-

Asset Group Impairment: The abrasives group of Chemical Products Incorporated (CPI) has been suffering a decline in its business, due to new product introductions by competitors. At 31 December 20X5,...

-

A company provided the following direct materials cost information. Compute the direct materials quantity variance. Standard costs assigned: Direct materials standard cost (485,000 units @...

-

On 1 January 2018, a company receives gross debenture interest of 1,600 from another UK company and pays net debenture interest of 8,640 to individuals. Explain the corporation tax treatment of each...

-

Identify the accounting periods which relate to the following periods of account: (a) Company A prepares accounts for the year to 31 December 2017. (b)Company B prepares accounts for the six months...

-

Refer to Exercise 26. a. Find X. b. Find 2 X . c. Find Cov (X,Y). d. Find X,Y. In Exercise 26 c(x + y)2 0

-

POTI ENTERPRISES LTD. STATEMENT OF INCOME FOR THE YEAR ENDED DECEMBER 31 (current year) SALES $600,000 COST OF SALES: $50,000 OPENING INVENTORY 250,000 PURCHASES 300,000 CLOSING INVENTORY 60,000...

-

10. Describe a qualified defined contribution plan for the self-employed and discuss the advantages and disadvantages in adopting this type of plan. 11. Describe a SEP IRA and discuss the advantages...

-

7.) In 1999, the average percentage of women who received prenatal care per country is 80.1%. Table #7.3.9 contains the percentage of woman receiving prenatal care in 2009 for a sample of countries...

-

Describe A demographic profile of the population and community that will be served through the reinvented Human Service program. The description must include all eligibility requirements (i.e.,...

-

You work for a major financial institution. Your branch handles customer calls from a wide variety of individuals. Recently, you've noticed an increase in calls from individuals from African...

-

Explain how it is possible for an entity with a high current ratio to have difficulty paying its bills.

-

D Which of the following is considered part of the Controlling activity of managerial accounting? O Choosing to purchase raw materials from one supplier versus another O Choosing the allocation base...

-

In June 2019 Katie acquired a 5-year option to buy a piece of land. The option cost her 10,000. In June 2021 she sold the option for 8,000. Compute the chargeable gain.

-

In January 2019 Katrina buys an item of movable plant and machinery for use in her business. The plant costs her 50,000 and capital allowances are claimed. Compute the chargeable gain arising in...

-

In January 2022 Karl sells a one-quarter interest in a chattel for 2,500. On the date of this sale, the remaining three-quarters interest is valued at 8,500. The chattel had cost Karl 3,850 in...

-

thumbs up if correct A stock paying no dividends is priced at $154. Over the next 3-months you expect the stock torpeither be up 10% or down 10%. The risk-free rate is 1% per annum compounded...

-

Question 17 2 pts Activities between affiliated entities, such as a company and its management, must be disclosed in the financial statements of a corporation as O significant relationships O segment...

-

Marchetti Company, a U.S.-based importer of wines and spirits, placed an order with a French supplier for 1,000 cases of wine at a price of 200 euros per case. The total purchase price is 200,000...

Study smarter with the SolutionInn App