Allan prepares accounts to 5 April each year. His acquisitions and disposals of plant and machinery in

Question:

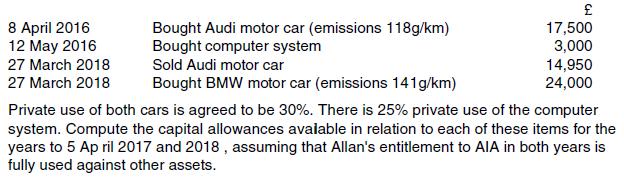

Allan prepares accounts to 5 April each year. His acquisitions and disposals of plant and machinery in the years to 5 April 2017 and 2018 include the following:

Transcribed Image Text:

8 April 2016 12 May 2016 27 March 2018 27 March 2018 Bought Audi motor car (emissions 118g/km) Bought computer system Sold Audi motor car Bought BMW motor car (emissions 141g/km) 17,500 3,000 14,950 24,000 Private use of both cars is agreed to be 30%. There is 25% private use of the computer system. Compute the capital allowances available in relation to each of these items for the years to 5 April 2017 and 2018, assuming that Allan's entitlement to AIA in both years is fully used against other assets.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

ye 5417 Additions WDA 18 WDA 18 WDV cf Total allowance...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Maurice prepares accounts to 5 April each year. The written down value of his main pool at 5 April 2017 was 10,300. There was no special rate pool. His purchases and sales of plant and machinery...

-

Maurice prepares accounts to 5 April each year. The written down value of his main pool at 5 April 2021 was 10,300. There was no special rate pool. His purchases and sales of plant and machinery...

-

Anita starts trading on 1 July 2017, preparing accounts to 30 June. Her only acquisitions and disposals of plant and machinery in the first three years of trading are as follows: Her AIA for the year...

-

Prove that the function x2 x - 1 | f (x) = x 1)(x 2) is differentiable for all r E (-0, 1) U (1, 2) U (2, ). - |

-

Sketch the probability mass function of a binomial distribution with n = 10 and p = 0.01 and comment on the shape of the distribution. (a) What value of X is most likely? (b) What value of X is least...

-

What docs a relatively high accounts receivable turnover indicate about a companys short-term liquidity?

-

Why is effective and efficient communication vital to a project? AppendixLO1

-

A physics experiment consists of recording paired data consisting of the time (seconds) elapsed since the beginning of the experiment and the distance (cm) of a robot from its point of origin. Using...

-

Answer is provided in image, I would like to see how the answer was worked out. Thanks. Numeric Response Numeric Response

-

Carla incurred a trading loss of 42 ,000 in the year to 30 June 2015 . Her trading profits for the following three years (adjusted for tax purposes) are as follows: Carla's only other income consists...

-

Ian owns a lar ge manufacturing business and prepares accounts to 31 December each year. The written down value of his main pool of plant and machinery after deducting capital allowances for the year...

-

Fill in the blanks with an appropriate word, phrase, or symbol(s). A compound statement that is always true is known as a(n) _______ .

-

Consider the expression timing is everything in relation to the building of the TOMS brand. Besides the influence of recovering economic conditions and the increased affluence of potential customers,...

-

What is corporate strategy and why is it important? Choose a company with which you are familiar, and evaluate its corporate strategy, especially in regards to financial strategies. What are some...

-

Assignment Tasks: Review the following situations and for each pay period determine the employee's net pay by calculating what earnings & benefits are subject to Income Tax, Canada / Quebec Pension...

-

sample letter for signature change on bank accounts for principals of school

-

Use Excelshowing all work and formulasto complete the following: Prepare a flexible budget. Compute the sales volume variance and the variable cost volume variances based on a comparison between...

-

A friend who owns a small entity trading as Jobs Galore knows that you are studying accounting, and has asked if you would prepare the entity's classified balance sheet as at 30 June. The friend has...

-

After Theorem 1.5 we note that multiplying a row by 0 is not allowed because that could change a solution set. Give an example of a system with solution set S0 where after multiplying a row by 0 the...

-

In the current year, White, Inc., earns $400,000 from operations and receives $36,000 in dividends and interest from various portfolio investments. White also pays $150,000 to acquire a 20% interest...

-

John, an engineer, operates a separate business that he acquired eight years ago. If he participates 85 hours in the business and it incurs a loss of $34,000, under what circumstances can John claim...

-

Rene retired from public accounting after a long and successful career of 45 years. As part of her retirement package, she continues to share in the profits and losses of the firm, albeit at a lower...

-

Your company produces a health magazine. Its sales data for 1 - year subscriptions are as follows: Year of Operation Subscriptions Sold % Expired at Year End 2 0 2 0 $ 3 0 0 , 0 0 0 5 2 0 2 1 $ 6 4 7...

-

Problem 3 - 2 0 ( Static ) Calculate profitability and liquidity measures LO 3 - 3 , 3 - 4 , 3 - 6 Presented here are the comparative balance sheets of Hames Incorporated at December 3 1 , 2 0 2 3...

-

3 Required information [The following information applies to the questions displayed below) John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter. Samantha. In 2020,...

Study smarter with the SolutionInn App