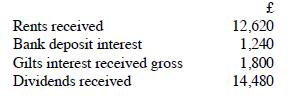

An interest in possession trust with two life tenants has the following income in tax year 2020-21:

Question:

An interest in possession trust with two life tenants has the following income in tax year 2020-21:

Property expenses incurred in the year were £2,220 and general administration expenses amounted to £1,850.

(a) Compute the trustees' income tax liability for 2020-21.

(b) Assuming that the trust income is divided equally between the two life tenants, calculate each life tenant's income from the trust in 2020-21.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: