Esm receives dividends of 17,000 in 2017-18 and has no other income. She makes a gross deductibl

Question:

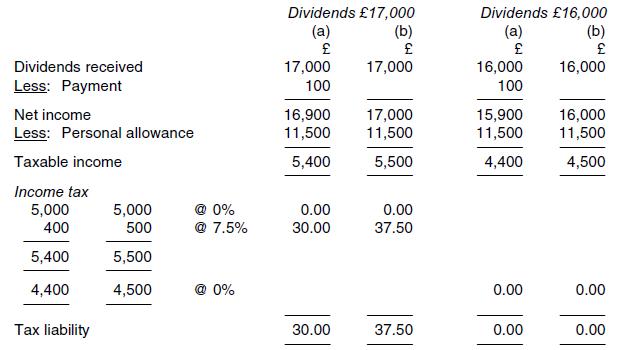

Esmé receives dividends of £17,000 in 2017-18 and has no other income. She makes a gross deductibl e payment of £10 0 during the year and claims only the basic personal allowance. Calculate Esmé's tax liability for the year:

(a) with the deductible payment

(b) as it would have been without the payment.

How would the situation differ if her dividend income had been £1,000 lower?

Transcribed Image Text:

Dividends received Less: Payment Net income Less: Personal allowance Taxable income Income tax 5,000 400 5,400 4,400 Tax liability 5,000 500 5,500 4,500 @ 0% @ 7.5% @ 0% Dividends 17,000 (a) 17,000 100 16,900 11,500 5,400 0.00 30.00 30.00 (b) 17,000 17,000 11,500 5,500 0.00 37.50 37.50 Dividends 16,000 (a) 16,000 100 15,900 11,500 4,400 0.00 0.00 (b) 16,000 16,000 11,500 4,500 0.00 0.00

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Notes i With dividends of 17000 Esms highest rate of tax is the dividend ...View the full answer

Answered By

Sidharth Jain

My name is Sidharth. I completed engineering from National Institute of Technology Durgapur which is one of the top college in India. I am currently working as an Maths Faculty in one of the biggest IITJEE institute in India. Due to my passion in teaching and Maths, I came to this field. I've been teaching for almost 3 years.

Apart from it I also worked as an Expert Answerer on Chegg.com. I have many clients from USA to whom I teach online and help them in their assignments. I worked on many online classes on mymathlab and webassign. I guarantee for grade 'A'.

4.90+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Since Ryanair DAC's2 emergence as an upstart challenger to the Aer Lingus Ltd.-British Airways plc duopoly in the late 1980s, it had been both a consumer champion and antagonist; a technological...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The U.S. Court of Appeals for the Fourth Circuit affirmed the lower court ruling in the case Public Employees Retirement Association of Colorado; Generic Trading of Philadelphia, LLC v. Deloitte...

-

Use the test of your choice to determine whether the following series converge. 1 + 1.3 1 3.5 + 1 5.7

-

Refer to the Fischer projection of D-(+)-xylose in Figure 25.2 (Section 25.4) and give structural formulas for (a) (-)-Xylose (Fischer projection) (b) D-Xylitol (c) -D-Xylopyranose (d)...

-

You have just been hired as a loan officer for Washington Mutual Savings. Selig Equipment and Mountain Bike, Inc., have both applied for $125,000 nine-month loans to acquire addi tional plant...

-

E12.9. Analysis of Changes in Operating Profitability: Home Depot, Inc. (Medium) Comparative income statements and balance sheets for the warehouse retailer Home Depot are given in Exercise E11.10 in...

-

Danny's Hamburgers issued 6%, 10-year bonds payable at 90 on December 31, 2018. At December 31, 2020, Danny reported the bonds payable as follows: Danny's pays semiannual interest each June 30 and...

-

Part 1 : Consider the following perpetual system merchandising transactions of Belton Company. Use a separate account for each receivable and payable; for example, record the sale on June 1 in...

-

In 2017-18, a taxpayer who pays income tax at 45% and capital gains tax at 20 % gives listed shares with a market value of 20,000 to a charity. There are no incidental costs of disposal and the...

-

Derek's total income for 2017-18 is 63,310 (entirely non-savings) and he makes a gross deductible payment of 3,000 in the year. He is not a Scottish taxpayer and he makes no Gift Aid donations or...

-

Elijah is single. He holds a $12,000 AMT credit from 2016. In 2017, his regular tax liability is $28,000 and his tentative minimum tax is $24,000. Does Elijah owe AMT in 2017? How much (if any) of...

-

You have recently taken over daycare center that was under substandard leadership. Currently, the staff is unmotivated, negative, and often absent from work. You notice that there is minimal...

-

Choose an organization from the industry of your choice to discuss, illustrate, and reflect deliberately on the following: Why is it important to distinguish between "group" and "team "? What kinds...

-

The focus of data governance programs, in some capacity, is enterprise-wide data quality standards and processes. If you were a manager focusing on master data: Would you likely meet enterprise-level...

-

1) Identify and explain each component of the ANOVA model. 2) How is the F ratio obtained? 3) What role does the F ratio play?

-

Make a BCG matrix table and place the following products from Apple: iPhone, iPad, iMac, iPod, Apple TV, Apple Watch, AirPod, and HomePod. Briefly describe why you have placed the products in the...

-

Consider the space ((, F) and for an arbitrary but fixed set A with ( ( A ( (, define FA by: FA = {B ( (; B = A ( C, C F}. Then FA is a field (of subsets of A).

-

What impact has the Internet had on the globalization of small firms? How do you think small companies will use the Internet for business in the future?

-

A company enters into 10,000 contracts with customers, all on the same date. These contracts have very similar characteristics and therefore (as a practical expedient) the company decides to apply...

-

A company is contracted to build an asset for a customer. The contract price is 5m but the contract stipulates that the company will receive an incentive payment of a further 1m if the asset is...

-

Define the term "revenue". Also explain the "five-step model" for the recognition and measurement of revenue which is set out in international standard IFRS15.

-

You would like to have a balance of $600,000 at the end of 15 years from monthly savings of $900. If your returns are compounded monthly, what is the APR you need to meet your goal?

-

Explain the importance of covariance and correlation between assets and understanding the expected value, variance, and standard deviation of a random variable and of returns on a portfolio.

-

On August 1 , 2 0 2 3 , Mark Diamond began a tour company in the Northwest Territories called Millennium Arctic Tours. The following occurred during the first month of operations: Aug. 1 Purchased...

Study smarter with the SolutionInn App