Happy Hippos (HH) is a manufacturer and retailer of New England crafts. HH is headquartered in Camden,

Question:

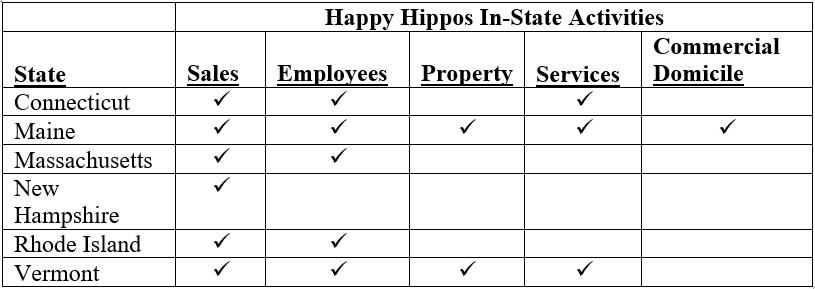

Happy Hippos (HH) is a manufacturer and retailer of New England crafts. HH is headquartered in Camden, Maine. HH provides services has sales, employees, property, and commercial domicile as follows:

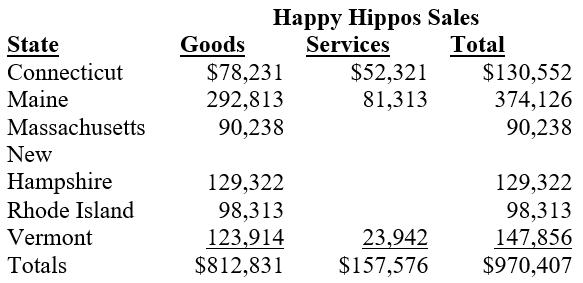

Happy Hippos sales of goods and services by state are as follows:

HH has federal taxable income of $282,487 for the current year. Included in federal taxable income are the following income and deductions:

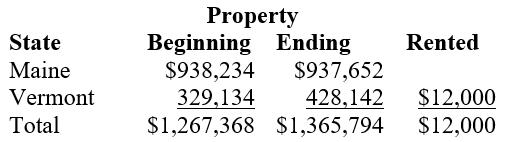

$12,000 of Vermont rental income;

City of Orono, Maine bond interest of $10,000;

$10,000 of dividends;

$2,498 of state tax refund included in income;

$32,084 of state net income tax expense; and

$59,234 of federal depreciation.

Maine state depreciation for the year was $47,923 and Maine doesn’t allow deductions for state net income taxes.

The employees present in Connecticut, Massachusetts, and Rhode Island are sales people who perform only activities protected by Public Law 86-272.

Each of the states is a separate-return state.

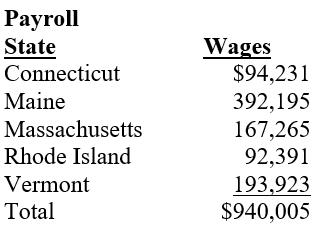

HH’s payroll is as follows:

HH’s property is as follows:

a) Determine the states in which HH has sales and use tax nexus.

b) Calculate the sales tax HH must remit assuming the following sales tax rates: Connecticut (6%), Maine (8%), Massachusetts (7%), New Hampshire (8.5%), Rhode Island (5%), and Vermont (9%).

c) Determine the states in which HH has income tax nexus.

d) Determine HH’s state tax base for Maine assuming federal taxable income of $282,487.

e) Calculate business and non-business income.

f) Determine HH’s Maine apportionment factors using the three-factor method (assume that Maine is a throwback state).

g) Calculate HH’s business income apportioned to Maine.

h) Determine HH’s allocation of non-business income to Maine.

i) Determine HH’s Maine taxable income.

j) Calculate HH’s Maine net income tax liability assuming a Maine tax rate of 5 percent.

Step by Step Answer:

Taxation Of Individuals And Business Entities 2015

ISBN: 9780077862367

6th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver