Hook, Line and Sinker begin trading as a partnership on 1 July 2015 , sharing profits equally.

Question:

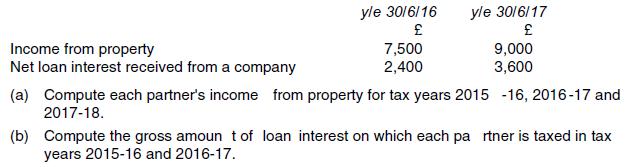

Hook, Line and Sinker begin trading as a partnership on 1 July 2015 , sharing profits equally. The chosen accounting date is 30 June and the first accounts are made up for the year to 30 June 2016 . In addition to its trading income, the partnership has non -trading income as follows:

Transcribed Image Text:

Income from property Net loan interest received from a company yle 30/6/16 7,500 2,400 yle 30/6/17 9,000 3,600 (a) Compute each partner's income from property for tax years 2015-16, 2016-17 and 2017-18. (b) Compute the gross amount of loan interest on which each partner is taxed in tax years 2015-16 and 2016-17.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

a Each partner is allocated property income of 2500 in the year to 30 June 2016 and 3000 in t...View the full answer

Answered By

Carly Cimino

As a tutor, my focus is to help communicate and break down difficult concepts in a way that allows students greater accessibility and comprehension to their course material. I love helping others develop a sense of personal confidence and curiosity, and I'm looking forward to the chance to interact and work with you professionally and better your academic grades.

4.30+

12+ Reviews

21+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Red and White begin trading as a partnership on 1 October 2014 , sharing profits equally. On 1 January 2016, they agree to admit Blue as a partner and to share profits in the ratio 3:2:1. The...

-

Tom, Dick and Harry begin trading as a partnership on 1 January 2016 , sharing profits in the ratio 3:2:1. With effect from 1 January 2017, they agree that Har ry should receive a salary of 20,000...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

CFR is a manufacturer of Industrial machines. During 2020, CFR launched a new machine with model name Omega. Each unit of Omega is being sold for Rs. 10 million payable upon delivery. Revenue from...

-

The probability of a successful optical alignment in the assembly of an optical data storage product is 0.8. Assume the trials are independent. (a) What is the probability that the first successful...

-

Explain the significance of demographic trends for future labour market conditions and the extent of diversity among the working population LO4

-

Develop a stakeholder analysis. AppendixLO1

-

Using the data presented in BE13-4 for Rosalez Company, perform vertical analysis.

-

what are the two main types of attestation services

-

Nickleby, Copperfield and Drood have traded as equal partners for many years, making up accounts to 31 December each year. As from 1 April 2017 they agree to share profits in the ratio 1:2:2. The...

-

Brendan ceases trading on 30 September 2017. His recent trading profits/(losses) are: He has no other income. Overlap profits of 4,700 arose when Brendan began trading and no claims are made to set...

-

Researchers M. Dhami et al. discussed how people adjust to prison life in the article "Adaption to Imprisonment" (Criminal Justice and Behavior, Vol. 34, No. 8, pp. 1085-1100). A sample of 712...

-

Working in the production area of a manufacturing company is right where William feels at home. Several of his family members had worked in similar environments throughout their careers, and he loves...

-

Use the Nernst equation and reduction potential data from (Petrucci's Appendix D; OpenStax's Table 16.1) to calculate Ecell for the following cell: Al (s) | Al3+ (0.18 M) || Fe+ (0.85 M) | Fe (s)

-

1.) Describe economic interventions that the federal government used to deal with the COVID shutdown and subsequent inflation. Would you have done anything differently? 2.) Describe three of the...

-

The goal is to understand the principles of project valuation and capital budgeting in a practical setting, using a combination of fictitious data and real-world examples. Begin by proposing a...

-

45. The use of realistic predetermined unit costs to facilitate product costing, cost control, cost flow, and inventory valuation is a description of the A. flexible budget concept. B. budgetary...

-

The Snags Software Company wants to increase its asset base by recognising the databases that it has created as assets. Discuss whether this is permissible under accounting standards.

-

The following data are supplied for the common stocks of Nikola Corporation, Tesla, Inc. and General Motors: Nikola Corp (NKLA) Tesla Inc. (TSLA) Close Price ($) Close Price ($) 67.53 30.00 40.81...

-

Mini, in Problem 16, reports $800,000 of pretax book net income in 2015. Mini did not deduct any bad debt expense for book purposes but did deduct $15,000 in bad debt expense for tax purposes. Mini...

-

You saw on the online Business News Channel that YoungCo has released one-third of its valuation allowances because of an upbeat forecast for sales of its tablet computers over the next 30 months....

-

Jill is the CFO of PorTech, Inc. PorTechs tax advisers have recommended two tax planning ideas that will each provide $5 million of current-year cash tax savings. One idea is based on a timing...

-

Suppose I have computed the cost of carbon per mile for my car at 0 . 0 1 2 per mile. Assume that the interest rate is 4 % and that I drive the car 2 8 , 0 0 0 miles per year. What is the present...

-

Imagine that in stable growth period, the firm earns ROIC of 10% and has after tax EBIT of 200 and reinvestment $ of 40. What is the steady state growth rate? 20% O 10% 2%

-

Tanner-UNF Corporation acquired as a long-term investment $160 million of 5.0% bonds, dated July 1, on July 1, 2021. Company management has the positive intent and ability to hold the bonds until...

Study smarter with the SolutionInn App