Iris (who is single) starts a business on 6 July 2020, preparing accounts to 5 April. Her

Question:

Iris (who is single) starts a business on 6 July 2020, preparing accounts to 5 April. Her adjusted trading loss for the nine months to 5 April 2021 is £15,000. However, she is expecting a trading profit of approximately £55,000 in the year to 5 April 2022.

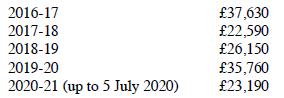

Before starting her own business, Iris was in employment. Her employment income in recent years has been as follows

She has no other income in any year between 2016-17 and 2021-21 inclusive. She is not a Scottish taxpayer.

Required:

(a) Assuming (for the sake of simplicity) that income tax rates, bands and allowances for all years are the same as those for 2020-21, calculate the effective percentage rate of tax relief that Iris would obtain if she claimed each of the following reliefs in relation to her trading loss:- relief against total income for the year of the loss, or - relief against total income for the previous year, or - early trade losses relief, or - carry-forward relief.

(b) Advise Iris as to the best course of action in relation to her loss.

Step by Step Answer: