Joanne started a business on 1 May 2016, preparing accounts to 31 December each year. Her first

Question:

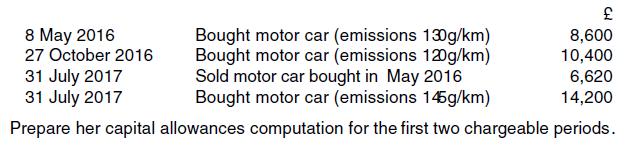

Joanne started a business on 1 May 2016, preparing accounts to 31 December each year. Her first accounts were for the period to 31 December 2016 . During this period and during the year to 31 December 2017 she bought and sold plant and machinery as follows:

Transcribed Image Text:

8,600 10,400 Bought motor car (emissions 130g/km) Bought motor car (emissions 120g/km) Sold motor car bought in May 2016 Bought motor car (emissions 145g/km) 6,620 31 July 2017 31 July 2017 14,200 Prepare her capital allowances computation for the first two chargeable periods. 8 May 2016 27 October 2016

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Notes i The motor cars bough t for 8600 and 10400 enter the main poo...View the full answer

Answered By

Ayush Jain

Subjects in which i am expert:

Computer Science :All subjects (Eg. Networking,Database ,Operating System,Information Security,)

Programming : C. C++, Python, Java, Machine Learning,Php

Android App Development, Xamarin, VS app development

Essay Writing

Research Paper

History, Management Subjects

Mathematics :Till Graduate Level

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Laura started a business on 1 May 2016, preparing accounts to 30 April . Her adjusted trading profit for the year to 30 April 2017 (before deduction of capital allow ances) was 263,150. Her purchases...

-

Talat owns a large retail business and prepares accounts to 31 December each year. The written down value of his plant and machinery after deducting capital allowances for the year to 31 December...

-

Explain the meaning of the terms emoluments, employments and office for the purposes of PAYE as you earn systems. 2. Explain the actual receipts basis of assessing the emoluments from the employment...

-

The probability that fewer than 35 people support theprivatization of Social Security A discrete random variable is given. Assume the probability of the random variable will be approximated using the...

-

Product codes of 2, 3, or 4 letters are equally likely. What is the mean and standard deviation of the number of letters in 100 codes?

-

LO7 Why are gifts of property not income to the person receiving the gift?

-

Describe the concept of earned value. AppendixLO1

-

H&R Blocks tax filing service allows customers to obtain faster tax refunds in two ways: (1) the customer can pay $25 for H&R Block to file the return with the Internal Revenue Service...

-

need all only otherwise don't touch it Case Study: Target Costing Aparajitha Limited is a leading Refrigerator Company and sells its products across the World. In the highly competitive environment,...

-

Norma has prepared a set of accounts for the nine -month period to 31 December 2017. The written down value of her plant and machinery at 31 March 2017 was as follows: 178,400 18,200 Main pool Toyota...

-

Lee begins trading on 1 January 2017 preparing accounts to 31 December each year. His adjusted trading profit for the year to 31 December 2017 (before capital allowances) is 21,000 and capital...

-

Use Inventory Table B and the gross profit inventory method to estimate the ending inventory and cost of goods sold if a 54% gross profit on sales is realized and net sales are $1,644.72.

-

1. create a concept map for 0D, 1D, 2D and 3D crystals 2. write down the formulas for quantifying numbers of defects

-

\fNOTES TO CONSOLIDATED FINANCIAL STATEMENTS OF AMERICAN AIRLINES GROUP INC . Commitments , Contingencies and Guarantees ( 2 ) Aircraft and Engine Purchase Commitment Under all of our aircraft and...

-

Critical Values. In Exercises 41-44, find the indicated critical value. Round results to two decimal places. 41. Z0.25 42. Z0.90 43. Z0.02 44. 20.05

-

Use the following information for questions 1 and 2. Caterpillar Financial Services Corp. (a subsidiary of Caterpillar) and Sterling Construction sign a lease agreement dated January 1, 2020, that...

-

In todays social and business environments, some organizations only talk the talk regarding ethics and ethical conduct rather than walk the ethical organizational path. In what ways can ethical and...

-

Identify whether the following liabilities would be classified as current or non-current as at the end of the reporting period.

-

For the vector whose polar components are (Vr = 1, Vθ = 0), compute in polars all components of the second covariant derivative Vα;μ;ν. To find...

-

Tulip, Inc., would like to dispose of some land it acquired four years ago because the land will not continue to appreciate. Its value has increased by $50,000 over the four-year period. The company...

-

What is the basis of the new property in each of the following exchanges? a. Apartment building held for investment (adjusted basis of $145,000) for office building to be held for investment (fair...

-

Rose Company owns Machine A (adjusted basis of $12,000 and fair market value of $15,000), which it uses in its business. Rose sells Machine A for $15,000 to Aubry (a dealer) and then purchases...

-

Berbice Inc. has a new project, and you were recruitment to perform their sensitivity analysis based on the estimates of done by their engineering department (there are no taxes): Pessimistic Most...

-

#3) Seven years ago, Crane Corporation issued 20-year bonds that had a $1,000 face value, paid interest annually, and had a coupon rate of 8 percent. If the market rate of interest is 4.0 percent...

-

I have a portfolio of two stocks. The weights are 60% and 40% respectively, the volatilities are both 20%, while the correlation of returns is 100%. The volatility of my portfolio is A. 4% B. 14.4%...

Study smarter with the SolutionInn App