Larry died on 1 November 2020 leaving an estate valued at 300,000. He had never had a

Question:

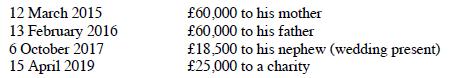

Larry died on 1 November 2020 leaving an estate valued at £300,000. He had never had a wife or civil partner and he left his estate to his best friend. On 1 October 2012 he had set up a discretionary trust and made a gross chargeable transfer to this trust of £275,000 (after deducting exemptions). His only other lifetime transfers were as follows:

Required:

Calculate the IHT payable (if any) on each of the four gifts and on the estate at death.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: