Melissa owns a house which she lets to tenants. The house was let througho ut tax year

Question:

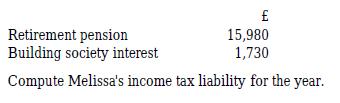

Melissa owns a house which she lets to tenants. The house was let througho ut tax year 2017-18 at a rent of £600 per month . Her allowable expenditure in 2017-18 was £900 and she had property losses brought forward from 2016 -17 of £6,550. Her other income in 2017-18 was as follows:

Transcribed Image Text:

15,980 1,730 Retirement pension Building society interest Compute Melissa's income tax liability for the year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

To compute Melissas income tax liability for the tax year 201718 we must first calculate her total taxable income from all sources and then apply the ...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Melissa (who is not a Scottish taxpayer) owns a house which she lets to tenants. The house was let throughout 2021-22 and rents received during the year were 7,300. Her deductible expenditure for the...

-

Ryan owns a house which he lets to a tenant. Rent is payable monthly in advance on the 6th day of each month. For some years the rent has been fixed at 7,200 per annum but this was increased to 7,800...

-

Andrew owns a house which he lets to tenants. Rent is payable quarterly in advance on 1 January, 1 April, 1 July and 1 October. The rent was 8,000 per annum until it was increased to 8,800 per annum...

-

A solid of constant density is bounded below by the plane z = 0, on the sides by the elliptical cylinder x 2 + 4y 2 = 4, and above by the plane z = 2 - x. a. Find x and y. b. Evaluate the integral...

-

The value cited for the apparent K1 of carbonic acid, 4.3 x 10-7, is the one normally given in reference books. It is determined by measuring the pH of water to which a known amount of carbon dioxide...

-

If a company had $15,000 in net income for the year, and its sales were $300,000 for the same year, what is its profit margin? a. 20% b. 2,000% c. $285,000 d. $315,000 e. 5%

-

E10.10. Free Cash Flow for Kimberley-Clark Corporation (Medium) Below are summary numbers from reformulated balance sheets for 2007 and 2006 for Kimberly-Clark Corporation, the paper products...

-

Institutionally Related Foundations. Compass State University Foundation (CSUF) was incorporated as a not-for-profit organization to support a public university in its fund-raising efforts and the...

-

the total amount of assets to be classified as investment

-

In 2017-18, Alfred had business profits of 15,8 70 and received net debenture interest of 1,520. He acquired the debentures on 1 July 2017 and accrued interest (gross) on 5 April 2018 was 950....

-

In 2017-18, Peter is granted a 12 -year lease on a property, paying a premium of 40,000 to his landlord. He immediately grants a 4 -year sub-lease to Paula, receiving a premium of 14,000. Calculate...

-

Why is profit not a suitable measure of divisional performance?

-

Question 37 Plantito Inc., produces potted plants. For next year, Pietro predicts that 45,000 units will be produced, with the following total costs: Direct materials Direct labor ? 80,000 Variable...

-

When you are to design a data transmission system, you have two key considerations to work with: data rate and distance, with emphasis placed on achieving the highest data rates over the longest...

-

How much work does a supermarket checkout attendant do on a can of soup he pushes 0.600 m horizontally with a force of 5.00 N? Express your answer in joules and kilocalories. 3 . (a) Calculate the...

-

Suppose in its income statement for the year ended June 30, 2022, The Clorox Company reported the following condensed data (dollars in millions). Salaries and wages expenses$460 Research and...

-

Consider the extensive form game show in the figure below. How many strategies does Player 2 have in this game? (2,2,1) b (2,4,2) 03 by 03 02 dz (4.2,0) (2.0.2) (0.3.4) (3,5,3) (3,1,2)

-

(i) If 1 and 1 are two measures on ((, A), then show that = 1 + 2 is also a measure, where (A) = 1 (A) + 2 (A), A ( A. (ii) if at least one of the measures 1 and 2 is complete, then so is

-

Design a circuit which negative the content of any register and store it in the same register.

-

Endale Ltd (which applies IAS17) prepares accounts to 31 March each year. On 1 April 2016, the company acquired an asset by means of a finance lease. The fair value of the asset on this date was...

-

On 1 July 2015, Helvelyn Ltd (which applies IAS17) entered into a finance lease to acquire a machine. The cash price of the machine would have been 132,000. The lease agreement specified that the...

-

Lees Ltd leases an assembly machine on a finance lease. The lease requires Lees Ltd to make five rental payments of 18,000 annually in advance. The fair value of the assembly machine is 75,000 and...

-

thumbs up if correct A stock paying no dividends is priced at $154. Over the next 3-months you expect the stock torpeither be up 10% or down 10%. The risk-free rate is 1% per annum compounded...

-

Question 17 2 pts Activities between affiliated entities, such as a company and its management, must be disclosed in the financial statements of a corporation as O significant relationships O segment...

-

Marchetti Company, a U.S.-based importer of wines and spirits, placed an order with a French supplier for 1,000 cases of wine at a price of 200 euros per case. The total purchase price is 200,000...

Study smarter with the SolutionInn App