Nathan begins trading on 1 October 2018, making up accounts to 31 December each year. His first

Question:

Nathan begins trading on 1 October 2018, making up accounts to 31 December each year.

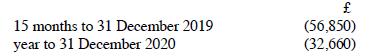

His first two sets of accounts show the following adjusted trading losses:

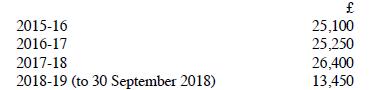

He has had no other income since becoming self-employed. Before this, his only income consisted of employment income, as follows:

Assuming that all possible early trade losses relief claims are made, calculate Nathan's net income (i.e. total income less reliefs) for years 2015-16 to 2018-19.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: