Olive ceases trading on 31 May 2017. Her recent adjusted trading profits/(losses) are: year to 30 June

Question:

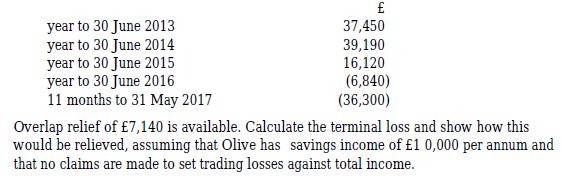

Olive ceases trading on 31 May 2017. Her recent adjusted trading profits/(losses) are:

Transcribed Image Text:

year to 30 June 2013 year to 30 June 2014 year to 30 June 2015 year to 30 June 2016 11 months to 31 May 2017 37,450 39,190 16,120 (6,840) (36,300) Overlap relief of 7,140 is available. Calculate the terminal loss and show how this would be relieved, assuming that Olive has savings income of 1 0,000 per annum and that no claims are made to set trading losses against total income.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

Olives trading losses need to be calculated to determine the terminal loss which occurs when a business comes to an end Well use the adjusted trading ...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Olive ceases trading on 31 May 2021. Her recent adjusted trading profits/(losses) are: Overlap relief of 7,140 is available. Calculate the terminal loss and show how this would be relieved, assuming...

-

Andrea ceases trading on 31 October 2017 . Her adjusted trading profits/(losses) for the closing periods of account are as follows: Overlap profits of 3,200 arose when Andrea commenced trading....

-

The income statement for Performance Limited is given below along with some supplementary information. Performance Limited Income Statement for the year ended December 30, 2020 (in $000s) Division A...

-

Samples of 20 parts from a metal punching process are selected every hour. Typically, 1% of the parts require rework. Let X denote the number of parts in the sample of 20 that require rework. A...

-

LO7 Return to the facts in problem 60. Assume that the securities have a fair market value of $2,000. What positive tax strategy exists in this situation? Explain.

-

What is a stakeholder? AppendixLO1

-

Consider the following characteristics of either a JIT production system or a traditional production system. a. Products are produced in large batches. b. Large stocks of finished goods protect...

-

Top management of Sheridan company is considering two alternative capital structures for 2 0 2 7 . The first ( the " no debt" structure ) would be to have $ 1 , 1 2 0 , 0 0 0 in assets and $ 1 , 1 2...

-

Marcus begins trading on 1 January 2016 and has the following results: (a) Compute his trading income (before loss relief) for 2015-16 to 2017-18. (b) Identify the claims that could be made in...

-

Jane is self-employed. Her recent adjusted trading profits/(losses) are: Jane has other in come of 10,000 per annum. Assuming that the trading loss is carried forward and set against future trading...

-

The statement of financial position of Urbax plc at 31 July 2020 (with comparatives for the previous year) is shown below: Notes: (i) Equipment which had cost 30,000 during the year to 31 July 2017...

-

MAT 152 Project 3: MLB Team Salaries The data set below is the total salary of each Major League Baseball (MLB) team salaries per team in 2016. Find the probabilities for normal distributions and...

-

deficit, surplusincreased, decreased$795, $1,975, $54,635, $35 6. Cash-flow statement Sam and Joan Wallingford have been married for two years. They have been trying to save but feel that there is...

-

Trudy bought the vacant lot adjacent to her house and planted a large garden there. The garden produces more vegetables than her family needs, and Trudy earns some extra cash by selling them at a...

-

Requirements Medical researchers once conducted experiments to determine whether Lisinopril is a drug that is effective in lowering systolic blood pressure of patients. Patients in a treatment group...

-

1. Balroop while looking for Gurjap walks 315m [N] toward the forest, then 133 m [28 S of E] through it, and finally finds him deep inside the forest after walking another 55 m [ 31 S of W]....

-

(a)What is the equity as at the end of the two financial years? (b) If Brionycontributed an extra $15 000 capital during the financial year ending 30 June 2013 and made no drawings, determine her...

-

Define the essential properties of the following types of operating systems: a. Batch b. Interactive c. Time sharing d. Real time e. Network f. Parallel g. Distributed h. Clustered i. Handheld

-

Kantner, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Based on this information, determine Kantners net deferred tax asset or net...

-

Define the terms temporary difference and permanent difference as they pertain to the financial reporting of income tax expenses. Describe how these two book-tax differences affect the gap between...

-

Based on the facts and results of Problem 49 and the beginning-of-the-year book-tax basis differences listed below, determine the change in Kantners deferred tax assets for the current year....

-

An underlying asset price is at 100, its annual volatility is 25% and the risk free interest rate is 5%. A European call option has a strike of 85 and a maturity of 40 days. Its BlackScholes price is...

-

Prescott Football Manufacturing had the following operating results for 2 0 1 9 : sales = $ 3 0 , 8 2 4 ; cost of goods sold = $ 2 1 , 9 7 4 ; depreciation expense = $ 3 , 6 0 3 ; interest expense =...

-

On January 1, 2018, Brooks Corporation exchanged $1,259,000 fair-value consideration for all of the outstanding voting stock of Chandler, Inc. At the acquisition date, Chandler had a book value equal...

Study smarter with the SolutionInn App